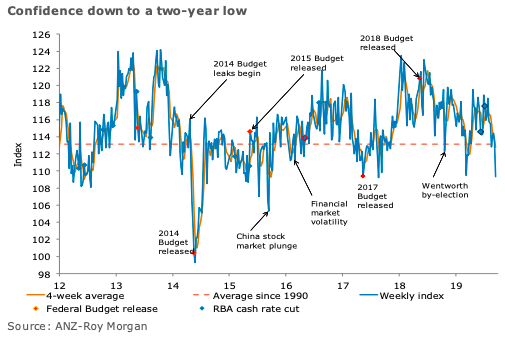

Australia’s ANZ-Roy Morgan consumer confidence plunged 3.5 percent last week to its lowest level in over two years. ‘Time to buy a household item’ was the only sub-index in the positive, eking out a 0.2 percent gain.

The financial conditions subcomponents dropped sharply. Current finances were down 4.6 percent, the third consecutive weekly decline, while future finances were down 4.8 percent.

The economic conditions sub-indices were also down, with current economic conditions losing 0.6 percent and future economic conditions falling by a sharp 7.6 percent, bringing it to a two-year low.

The four-week moving average for inflation expectations increased by 0.1ppt to 4.1 percent, despite a small decline in the weekly reading.

"ANZ-Roy Morgan consumer confidence fell to two year low last week. While households feel okay about their current financial situation, they are clearly quite worried about the outlook, for both their own finances and the economy. Last week’s reported fall in business conditions to a five-year low, the weekend attack on Saudi Arabia’s oil and ongoing broader concerns about both the domestic and global economic outlook are now clearly weighing on consumer sentiment. This is a disappointing development and suggests that expectations for tax and interest rate cuts to spur the consumer to lift the economy may be misplaced," said Felicity Emmett, ANZ Senior Economist.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations