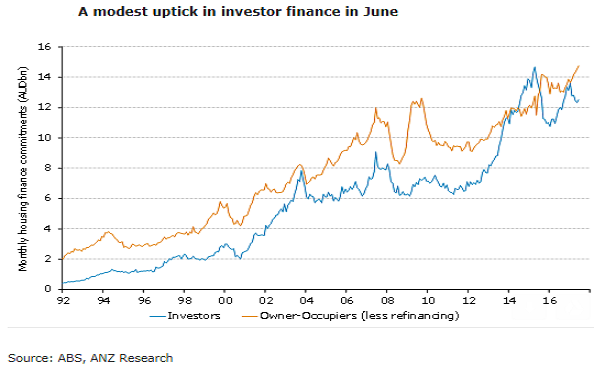

The notable feature of the June housing finance data was the bounce in investor financing, up 1.6 percent m/m in value terms. This is the biggest increase in investor financing since January. A marked acceleration of investor financing would be a disturbing development for the regulator and RBA.

The value of housing finance commitments (excluding owner occupier refinancing) rose 1.5 percent m/m in May, slowing annual growth to 7.1 percent y/y from 9 percent the previous month. The investor finance segment bounced in June, with the value of investor housing up 1.6 percent m/m in June after falling in three of the four months prior.

As a consequence of these previous declines the annual pace of growth in investor finance slowed to 5.7 percent in June from 8 percent y/y in May and down from double digit y/y growth in April. The value of owner-occupier approvals (excluding refinancing) recorded the fifth consecutive monthly rise, up 1.4 percent m/m in June.

Owner-occupier approvals (excluding refinancing) are 8.3 percent higher over 12 months, a slowdown from the 9.8 percent y/y growth recorded in May but still the second fastest annual growth since May 2016.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022