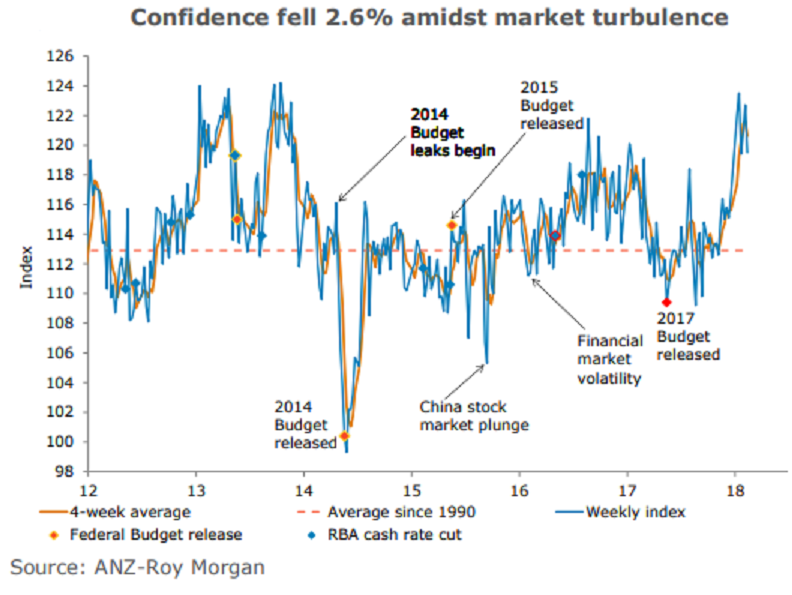

Australia’s ANZ-Roy Morgan consumer confidence fell 2.6 percent last week to 119.5, retracing gains over the previous two weeks. All sub-indices posted declines, though the ‘current economic conditions’ sub-index was the main culprit.

Households’ sentiment towards current economic conditions dropped a sharp 6 percent, unwinding much of the 8.3 percent cumulative rise over the previous two weeks. Views towards future conditions slipped 0.7 percent, its second straight weekly fall.

Consumers were also less optimistic about financial conditions this week. Views towards current and future conditions fell 2.6 percent and 1.8 percent respectively. In four week moving average terms, aggregate financial conditions sit at 116.0, down from their high of 118.5, two weeks ago.

Sentiment around the ‘time to buy a household item’ fell for the fourth straight week, slipping 1.9 percent to 136.9. Inflation expectations edged down to 4.4 percent on a four-week basis.

"Together with moderating house prices and high levels of debt, household finances remain under pressure. On this front, Governor Lowe’s speech last week, which in our view effectively removed the prospect of a rate hike this year, should provide some comfort. The upcoming employment and wage numbers will likely set the tone for confidence over the coming weeks. Further financial market volatility may also have an impact," said David Plank, Head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility