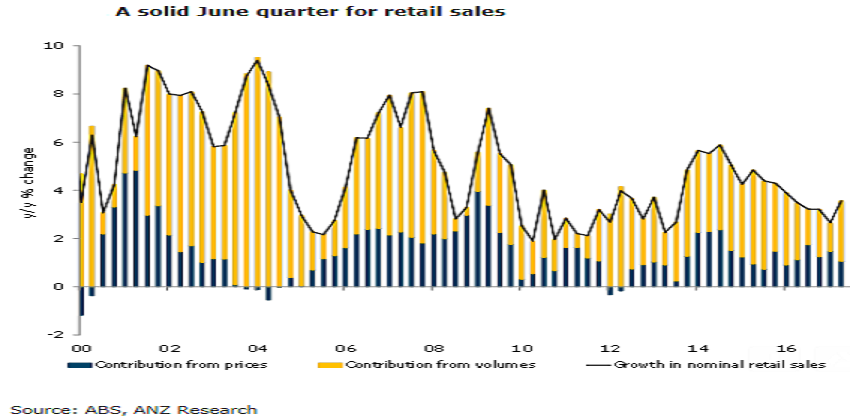

Australia’s Retail sales rose 0.3 percent m/m in June, a solid outcome given the strength in the previous two months. Retail sales volumes were up a strong 1.5 percent q/q in Q2, the fastest pace since Q1 2013, supported by rises across all categories. However, retail price inflation remains weak, with prices falling by 0.1 percent q/q in Q2.

International competition continues to weigh on retail prices. Indeed, the only category to record higher prices was cafes, restaurants and takeaway food. The data sets up a solid base for Q2 GDP (to be released on September 6).

Annual growth in retail sales was steady at 3.8 percent y/y in June, while sales rose by 7.9 percent on a three month annualised basis. Retail sales fell in Victoria (-0.3 percent m/m), reversing two months of very strong outcomes. Sales rose in all other states and territories except the ACT.

Department store sales fell for the second consecutive month while food sales were flat in both May and June. Clothing sales rose by 0.8 percent m/m in June and are up just 1.7 percent y/y. Sales of household goods remain relatively strong, up 5.9 percent y/y in June, while café, restaurants and take away sales were also up a solid 5.6 percent y/y.

"We remain cautious about the outlook for consumption as households grapple with a variety of headwinds including weak wage growth, high indebtedness, slowing house price growth and higher energy bills – a sentiment echoed by the RBA," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election