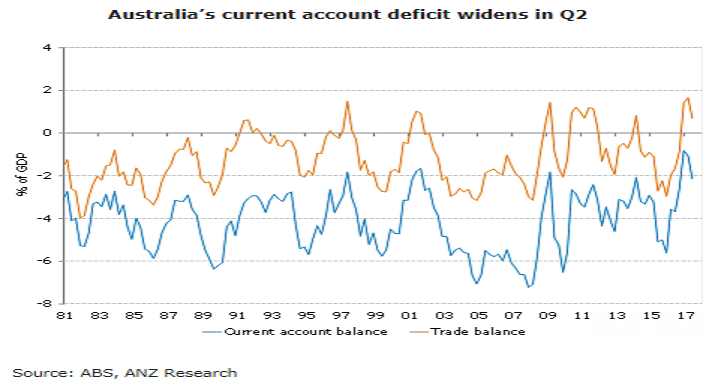

Australia’s current account deficit (CAD) widened broader than what markets had initially anticipated during the second quarter of this year, driven by a fall in the trade surplus on the back of lower commodity prices. However, the income deficit widened modestly.

The country’s CAD fell to AUD9.6bn from a downwardly revised AUD4.8 billion in Q1 2017. This was well below market expectations. The widening in the trade deficit was almost entirely driven by a sharp fall in the trade surplus; while the income deficit widened modestly. Net exports look to have added 0.3ppt to Q2 GDP growth.

After falling in Q1, the volume of exports rose a solid 2.7 percent q/q. The strength in volumes was largely driven by a jump in resource exports (up 3.9 percent q/q). Within this category, the gains were broadly based, with the only exception of coal exports which fell 6.8 percent on the back of the disruptions created by the Cyclone Debbie. After a strong rally over the previous four months, export prices fell sharply in Q2, down 5.4 percent q/q. The drop in export prices was driven by the weakness in commodity prices in the recent quarter.

Import volumes rose a solid 1.2 percent q/q in Q2. The strength in imports was broadly based, with a pickup in the volume of capital goods imports driving the gain (up 2.8 percent q/q). Import prices ticked higher – up 0.6 percent in quarter. The terms of trade dropped by 6.0 percent in Q1, following four months of uninterrupted rises.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election