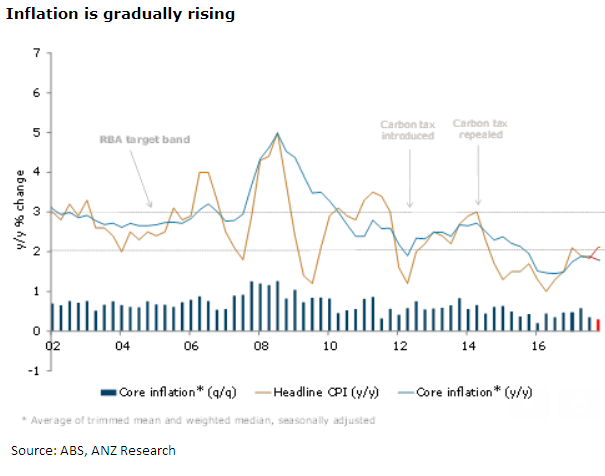

Australia’s consumer price inflation for the fourth quarter of last year is expected to show a slight pick-up in headline inflation and a broad stabilisation of core inflationary pressures. Numbers in line with forecast should support the case for a tightening by the RBA in May, ANZ Research reported.

Headline inflation is expected to rise 0.7 percent q/q for, lifting the annual rate to 2 percent y/y, from 1.8 percent in Q3 and the 1 percent low in Q2 2016. Petrol, tobacco and domestic travel and accommodation added to headline inflation in Q4. There is a higher-than-normal degree of uncertainty around this forecast given the introduction of the updated weights and methodological changes, both of which weigh on inflation.

"We expect core inflation to rise by 0.4 percent q/q and 1.8 percent y/y. This is broadly stable from the previous quarter but a clear acceleration from the 1.5 percent y/y annual rate in 2016," the report said.

Meanwhile, benign inflationary pressures continue to reflect weak wages and the impact of retail competition. With retail competition set to remain intense, the recent stabilisation in wage growth is encouraging although we continue to look for only a very gradual pick-up in wages. There does, however, appear to be some upside risk to housing inflation, given the recent strength in building approvals adding to an already solid pipeline of residential construction activity.

Lastly, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns