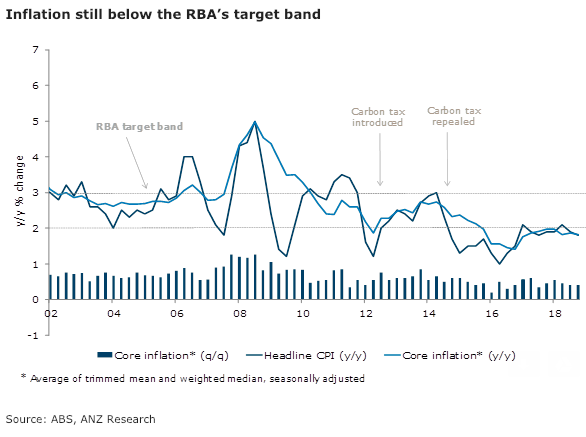

Australia Q4 2018 core inflation came in in line with expectations (market’s and the RBA’s), while headline inflation was slightly stronger than market expectations. The ANZ Diffusion Index was up slightly, indicating that a greater share of the items in the CPI basket are growing at annualised rates greater than 2.5 percent.

Encouragingly, domestic markets service inflation improved to 2.1 percent y/y, suggesting that higher unit labour costs are flowing through to consumer prices. This is important for the inflation outlook, given that the weakness in house prices, rents and secular weakness in retail prices will impede an improvement in inflation.

While the core result was in line with the RBA’s forecast, a lift in core inflation is required in the first half of 2019 to reach the Bank’s June 2019 y/y forecast of 2 percent. This seems a tough ask in light of the loss of economic momentum in the second half of 2018.

Q4 CPI showed a slight improvement in headline inflation which rose 0.5% q/q, although in annual terms it slowed to 1.8 percent (from 1.9 percent in Q3). The largest contributions came from the 9.4 percent increase in tobacco prices and a 6.2 percent lift in domestic airfares. Offsetting this slightly was a 2.5 percent fall in petrol prices.

Core inflation was steady compared to the previous quarter, with both the trimmed mean and weighted median rising by 0.4 percent. This left the annual growth rate (the average of the two measures) steady at 1.8 percent. CPI ex-volatiles (also looked at by the RBA) rose to 0.6 percent q/q, the best result since 2015.

"In a good sign, the ANZ Diffusion Index (which measures the proportion of the basket with annualised price rises of 2.5 percent or more) improved to 39 percent from 37 percent in Q3. This supports our view that the effect from the one-off decrease in administered prices is fading," ANZ Research commented in its latest report.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility