Australian Bureau of Statistics, is set to release Australia's Private capital expenditure for the third Quarter. Analysts forecast a decline in Q3 Capex, which is expected to offset the small increases over the previous two quarters. The fall in Capital expenditure is forecast to have been led by declines in the engineering sector. Spending on buildings and structures is likely to be a major drag. Release of the Construction Work Done numbers last week suggest that underlying investment in the mining sector in Western Australia continued to fall heavily.

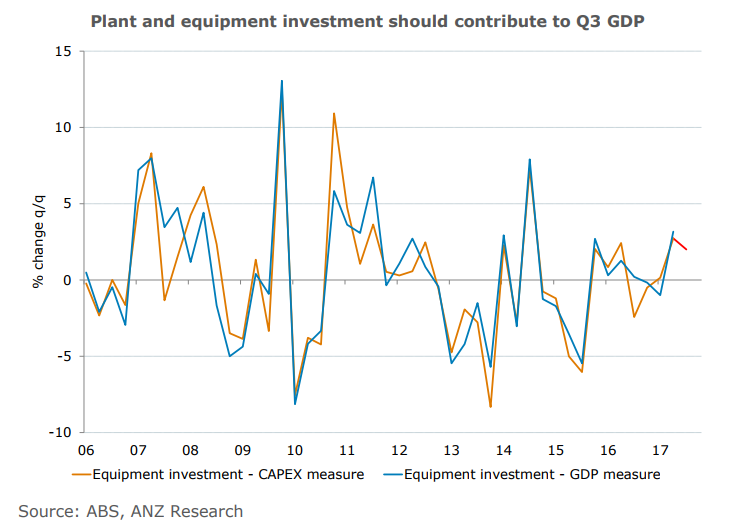

Capex is viewed as a precursor to GDP data (due for release on 6th December) and plant and equipment spending which shows direct contribution into GDP is expected to record solid growth in line with strong capital imports in the quarter. Analysts at ANZ Research expect spending on plant and equipment to rise by 2.0% q/q. Further, we anticipate a solid upward revision to firms' spending plans for 2017-18, given strength in business conditions.

"Q3 GDP is expected to confirm solid economic activity, with our preliminary pick a rise of 0.8% q/q, which would lift annual growth to a healthy 3.1% y/y." said ANZ in a report to clients.

Australia's Q3 inflation was surprisingly soft, headline inflation in Q3 rose by less than expected, even with energy prices rising. Core inflation has undershot the Reserve Bank of Australia’s (RBA) long-term target band of 2 to 3 percent for the seventh straight quarter leading investors to pare back the already slim chance of a rate hike in the coming months.

"We expect the RBA to tighten 50bp in 2018, removing its 2016 stimulus. The softness in Q3 inflation and wage data suggest downside risks to our pick despite the robust outlook for activity," adds ANZ.

The Australian dollar is seen extending recovery from 5-month lows at 0.7532 hit last week. AUD/USD was trading at 0.7638 at the time of writing, up 0.36% on the day. Technical indicators are supporting upside in the pair. 20-DMA at 0.7632 is strong resistance and decisive close above could see further gains. Scope then for test of 200-DMA at 0.7694. Breakout above 200-DMA could see further upside. We see major trendline support at 0.7532, weakness to accentuate on break below.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary