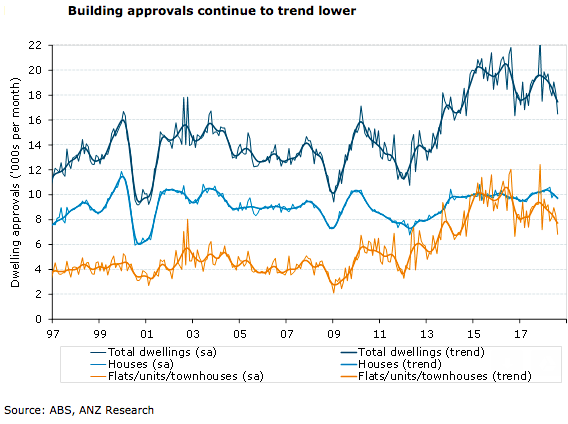

Australia’s residential building approvals are expected to continue to trend lower in the near term given the tighter credit conditions facing both developers and would-be new home purchasers, according to the latest report from ANZ Research.

Further, building approvals fell a sharp 9.4 percent in August, following a weak result in July (-4.6 percent m/m). Total residential approvals are down close to 14 percent y/y, with units approvals (-24 percent) seemingly more affected by tighter credit conditions than house approvals which have fallen a much more modest 4 percent.

Across the states, ACT saw a very sharp fall (-65 percent) as a jump in unit approvals in July was reversed, while Victoria was also very weak with a 35 percent m/m drop in unit approvals. Unit approvals in Victoria are now down a sharp 46 percent y/y. Approvals were also weak in Queensland, while WA saw a solid rise.

Meanwhile, non-residential approvals fell a sharp (-24 percent m/m), following the 31 percent jump in July. This series is particularly volatile, but is trending lower after a very strong 2017.

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility