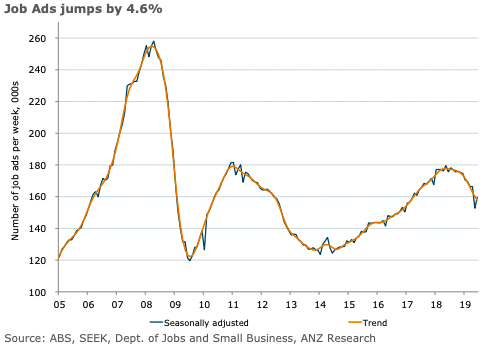

Australia’s ANZ job ads bounced back in June after falling more than 8 percent in May. The ‘Holiday-year effect’ in late April and the timing of the election appear to have been responsible for much of the decline in May, and the rebound in June can be seen as an unwinding of that effect.

In seasonally adjusted terms, job ads gained 4.6 percent m/m but fell by 9.1 percent y/y. In trend terms, job ads fell 1.4 percent m/m and 11.1 percent y/y.

"Job ads in June jumped 4.6 percent, reversing a bit more than half of the sharp drop in May. The gain was one of the biggest in 18 months. We don’t think it necessarily represents a turn in the overall downward trend, however. Job ads plunged more than 8 percent in May as a result of the timing of the election and the late April ‘holiday year’ effect (when Easter and ANZAC Day were close together). The subsequent jump in job ads in June represents only a partial recovery from that weakness, suggesting that the overall trend is still downwards. This points to slowing employment growth and rising unemployment. If confirmed by the actual employment data, then the RBA will likely react by lowering the cash rate yet again," said David Plank, ANZ’s Head of Australian Economics.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions