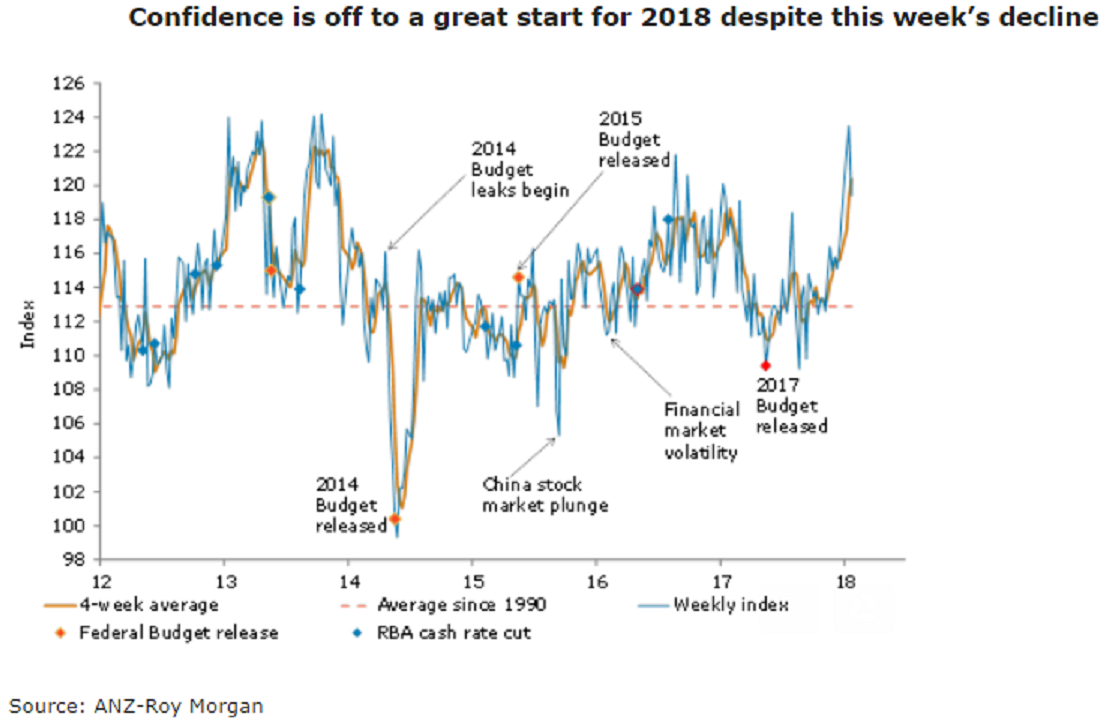

Australia’s ANZ-Roy Morgan Australian consumer confidence fell 3.3 percent last week following three consecutive strong reports. The fall was broad-based, with views towards current finances leading the pullback.

The current finances sub-index fell a sharp 9.1 percent to 104.7, partially unwinding gains over the previous three weeks. In comparison, views towards future finances fell a more modest 2.2 percent, following a 0.2 percent decline in the week prior. Despite the weekly falls, both sub-indices sit above their long-term average.

Households’ pessimism also extended towards the economic outlook. Views on current and future economic conditions dipped 3.6 percent and 1.3 percent respectively, though both sub-indices remain elevated compared to recent lows.

Sentiment around the ‘time to buy a household item’ slipped 1 percent last week following a 7.9 percent rise over the preceding two weeks. Four-week moving average inflation expectations edged up by 0.1 percent to 4.6 percent.

"Looking past the weekly volatility, we expect sentiment to remain supported by a strong labor market and a solid outlook for economic activity in 2018," said David Plank, Head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX