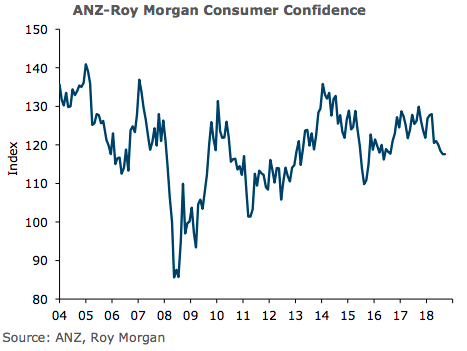

Australia’s ANZ-Roy Morgan consumer confidence index, which was unchanged in September at 118, close to the historical average. The current conditions index fell 4 points to 120, while the future conditions index lifted 2 points to 116.

Consumer confidence remains pretty steady – and pretty average. Perceptions of current conditions remain strong, but there is some caution about the future, particularly around the broader economy rather than respondents’ own financial situations.

One of the most useful questions in the survey is whether respondents think it’s a good time to buy a major household item. This question bucked the trend this month, dipping 6 points to be the lowest in three years – admittedly three unusually stable year. This is worth keeping an eye on.

"The growth indicators out of business surveys are impacted around times of political change, and we await further evidence to assess how large the growth hiccup may prove. But monetary conditions and fiscal policy are stimulatory, and barring a global shock, we suspect the economy will muddle through," ANZ Research reported.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals