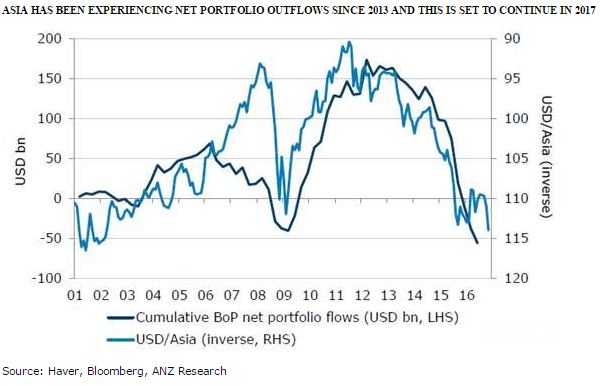

Asian currencies are expected to depreciate for the fifth straight year, going into 2017, following mounting global headwinds; also sharp appreciation in the greenback will pose serious threats to major Asian currencies.

Rising US interest rates on the back of continued policy normalization by the US Federal Reserve and prospects of fiscal stimulus from a Trump administration is set to keep the USD bid. Asian economic growth should eventually benefit from a better performing US economy. But a stronger USD and rising US yield environment tends to cause volatility in capital flows and pose a headwind to Asian currencies.

Further, there remain potential risks from a rise in the Chinese yuan, although Chinese authorities have put up efforts to keep the RMB index stable. According to the report, ANZ remains bearish on both KRW as well as SGD. The real effective exchange rates of both currencies are elevated given the state of their economic cycles. A re-centring of the policy band by MAS is likely in 2017.

INR’s and IDR’s macroeconomic fundamentals have improved such that they are less vulnerable to rising US yields compared to the taper tantrum period. But with both countries running higher inflation rates compared to their trading partners, some nominal currency weakness can be expected, though this is compensated by their higher yield.

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns