Chip designer Arm Holdings (NASDAQ:ARM) reported stronger-than-expected third-quarter earnings, but its muted outlook for the current quarter led to a more than 5% drop in after-hours trading.

The company posted earnings per share (EPS) of $0.39, surpassing analysts' expectations of $0.25. Revenue reached $983 million, exceeding the projected $946.8 million. Despite these strong results, investors reacted to Arm’s Q4 forecast, which fell mostly in line with Wall Street predictions.

For the fourth quarter, Arm expects EPS between $0.48 and $0.56, compared to analysts’ consensus of $0.53. Revenue is projected to range from $1.175 billion to $1.275 billion, closely aligning with the $1.23 billion forecast.

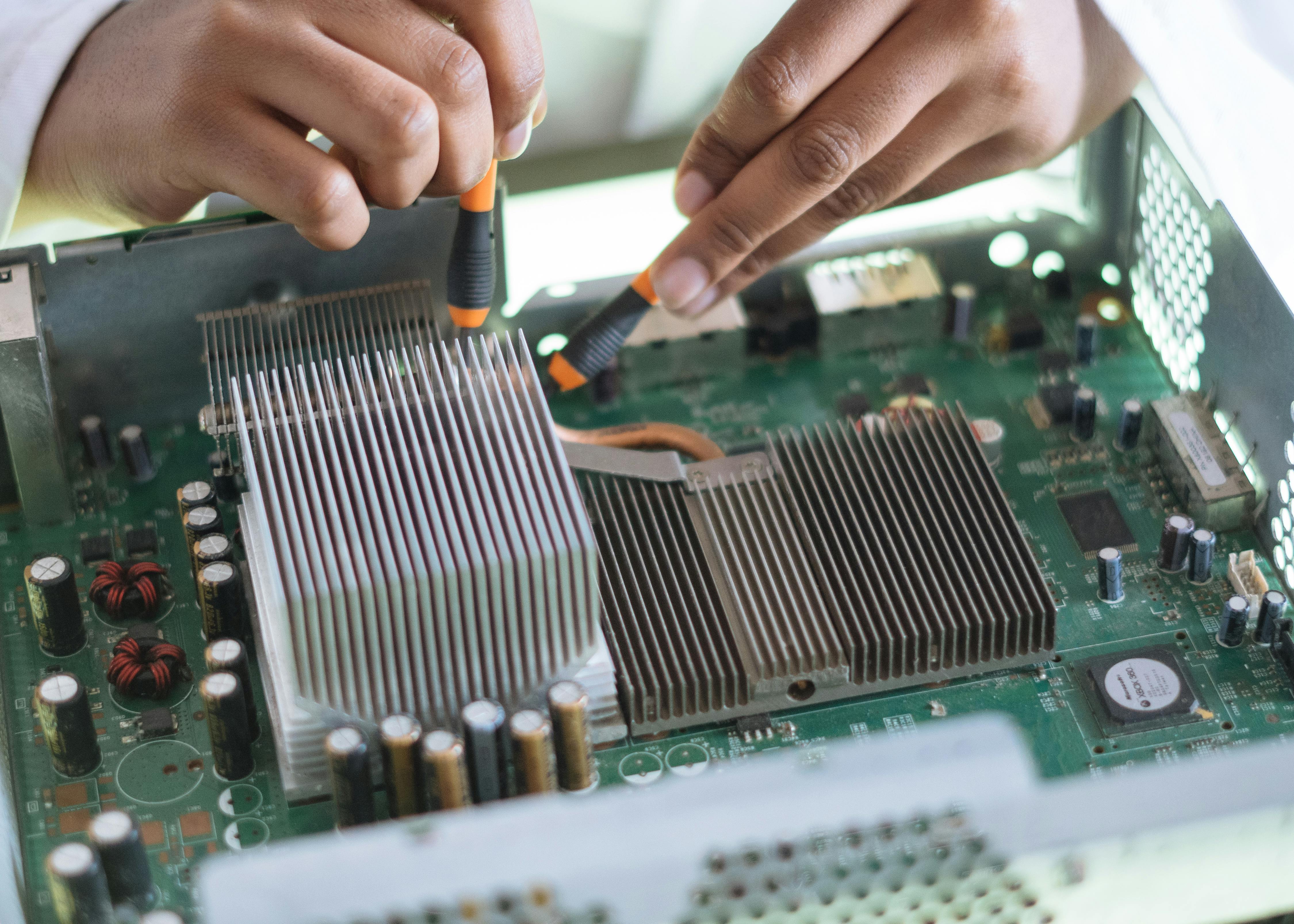

Arm’s growth is fueled by the rising demand for AI-driven semiconductor designs. The company licenses its energy-efficient chip architectures to top semiconductor firms, benefiting from the industry's shift toward power-efficient computing.

Despite the positive earnings surprise, the market’s reaction suggests concerns over growth sustainability and valuation expectations. Investors may be reassessing Arm’s long-term AI market positioning and whether its current trajectory justifies its stock price.

As AI adoption accelerates, Arm remains a key player in the semiconductor sector, with its designs playing a crucial role in next-generation computing. However, its stock performance will likely depend on how well it can meet future demand and sustain revenue growth in an increasingly competitive market.

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates