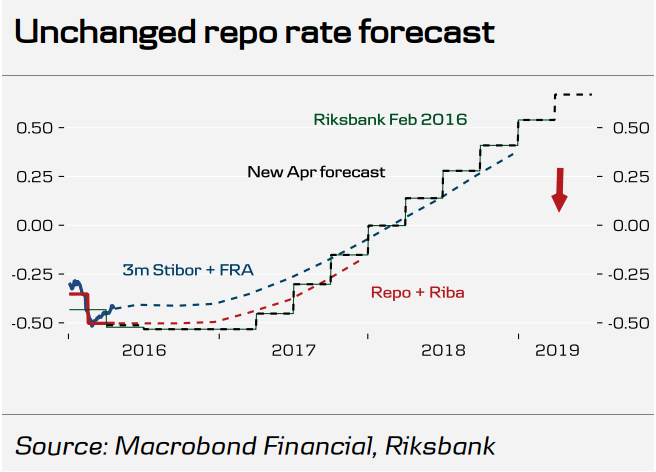

Sweden's central bank held its benchmark rate unchanged at -0.50 percent as expected on Thursday but said it would expand its asset purchase programme. SEK appreciation post ECB decision to cut rates in March had put significant pressure on the Riksbank to deliver something today. Analysts had been unanimous in expecting no change in rates, but held out the chance the Riksbank would extend its bond purchase programme either now or in the months to come - depending on the currency and what the ECB does.

Sweden's Executive Board today decided to purchase government bonds for a further 45 billion Swedish crowns ($5.6 billion) during the second half of 2016. This is the bank's latest effort to lift inflation to a 2% target it hasn’t hit for over four years. In a precautionary step aiming to keep the SEK from appreciating too fast (not to break the upward trend in inflation), the central bank added SEK15bn in linkers. The central bank also hinted that there could be changes in its mandate – “We find ourselves in a situation where the strategies and regulatory frameworks followed by central banks in the past decades must be reassessed.”

"An extension of the QE programme was expected, even if it was a little smaller than we had thought," said Knut Hallberg, economist at Swedbank. "The crown is still a dilemma for the Riksbank."

Sweden has struggled in recent years to adapt its monetary policy to an economy that is now growing so fast it is in danger of overheating. Sweden’s annual inflation rate was 0.8% in March, up from 0.4% in February (but remains below the central bank's 2% target). Inflation has overshot the central bank's expectations for three months in a row, which has caused many analysts to believe the Riksbank is probably drawing close to the end of its easing cycle.

Many central banks (Sweden, Denmark and Switzerland, ECB, BoJ) are now testing sub-zero interest rates as a way to raise inflation or control an exchange rate. It is to be seen if the (negative interest rate) policy can help attain monetary-policy goals without adverse side effects. Critics worry that such low rates could inflate an asset price bubble or damage the ability of commercial banks to make money.

Ironically, the Riksbank's efforts in slowing the Krona have failed again. The Swedish Krona appreciated strongly against Dollar and Euro post rate decision. In a knee-jerk reaction, the Krona was up around 0.5% against Euro, taking EUR/SEK to lows of 9.1151. The dip was however quickly faded, EUR/SEK was trading at 9.1740 at 1020 GMT. USD/SEK also pared losses from lows of 8.0641 to trade at 8.1238. Markets now await ECB policy meeting due later in the EU session.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary