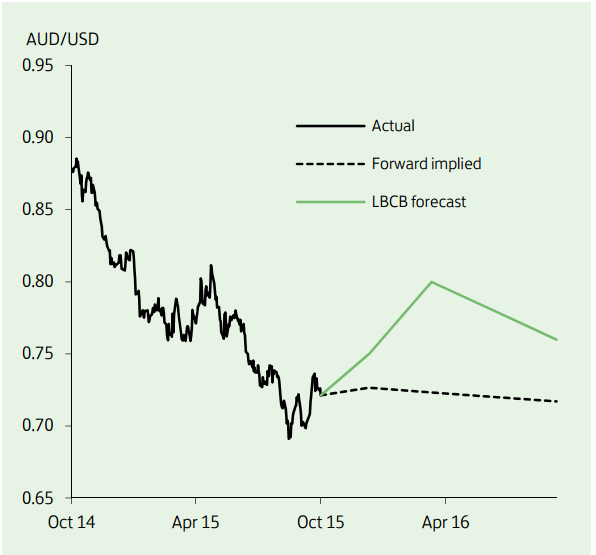

The Australian dollar has risen from its September low of 0.6896 against the USD, but its downward trend remains intact. Economic data from China, Australia's largest trading partner, and movements in metals prices, a key export commodity, have not yet been convincing enough to fully price out the possibility of a future interest rate cut by the RBA moving into next year. Market pricing, however, is somewhat inconsistent with more neutral comments from the RBA after its October meeting, when it left the cash target rate unchanged at 2.00%.

In addition, RBA Governor Stevens has suggested the exchange rate is near fair value at current levels and is currently below the central bank's target level of 0.75 against the USD. This provides a strong signal that we may have reached the bottom in the Australian dollar after depreciating by nearly 11% against the USD since the start of the year.

Even a modest improvement in economic data from China should leave the Aussie ripe for a retracement back to 0.77-0.80 mid-next year. Upward pressure from there is likely to be capped by Fed policy tightening

AUD/USD Outlook

Wednesday, October 21, 2015 9:59 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022