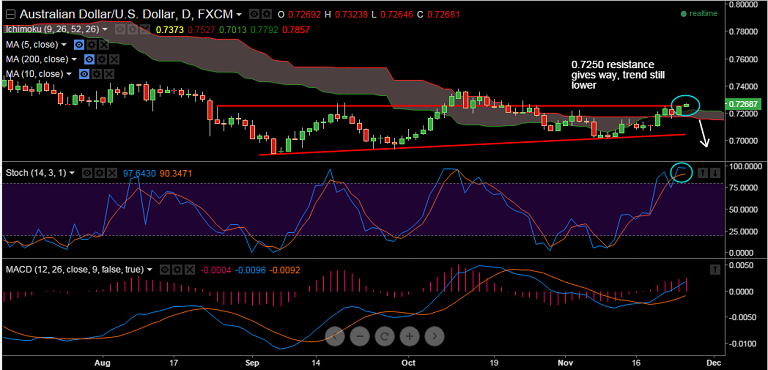

- AUD/USD popped higher to 0.7275, a one-month peak, after a key level around 0.7250 finally gave way

- Net M&A inflows seem to be supportive for AUD at the moment but this is - as always - hard to nail down

- RBA governor Stevens reiterated in yesterday's speech that there is room to cut interest rates "if that actually helps."

- AUD still outperformed, this despite iron ore falling 1.9% to $43.89/tonne - a record low, the rise was definitely not driven by fundamentals

- Also underpinning the the was some profit taking in the U.S. dollar in the lead-up to Thanksgiving holidays and a surprise drop in U.S. consumer confidence and rising global tension between Russia and Turkey

- AUD/USD trend is still lower. We would still go short on rallies. Recommend raising stops to 0.7320 for our previous call

http://www.fxwirepro.com/fxwire/popup.htm?id=732829

Resistance Levels:

R1: 0.7297 (Daily High Oct 23)

R2: 0.7298 (Daily High Oct 20)

R3: 0.73 (Psychological Level)

Support Levels:

S1: 0.7216 (Cloud top)

S2: 0.7208 (100-Day MA)

S3: 0.7186 (Session low Nov 24)