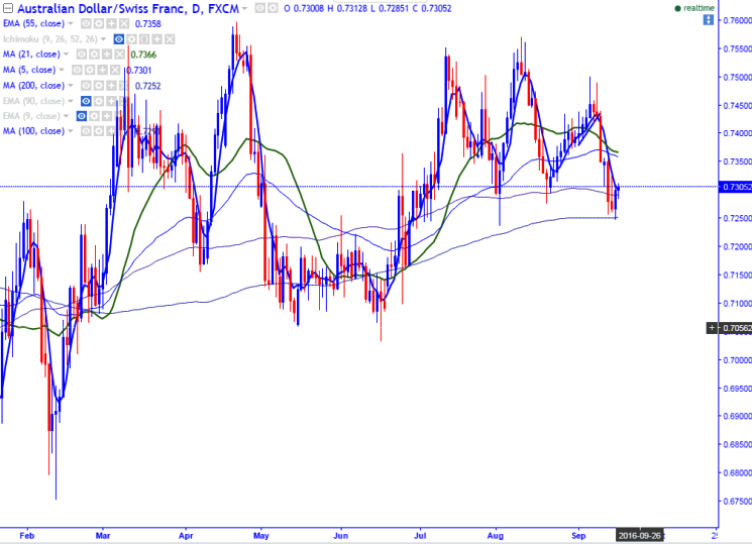

- Major support – 0.7250 (200- day MA).

- The pair has taken support at 200- day MA and jumped from that level. It is currently trading around 0.7307.

- AUD/CHF is trading slightly above 100- day MA and it trading well below 10- day MA (0.7370).the pair should break above 10- day MA for further bullishness. Any break above 0.7370 will take the pair to next immediate level at 0.7404 (daily Kijun-Sen)/0.7440 (61.8% retracement of 0.7570 and 0.72470).

- On the lower side, support stands at 0.7250 and any break below targets 0.7169/0.7070 (61.8 % retracement of 0.6750 and 0.75976).

It is good to sell on rallies around 0.7320-25 with SL around 0.7370 for the TP of 0.7250/0.7205.

Resistance

R1- 0.7370

R2-0.7405

R3-0.7440

Support

S1-0.7250

S2-0.7200

S3-0.7169