WTI is struggling since it reached our forecasted target area around $41-42/barrel. Currently it is trading at $39/barrel.

Key factors at play in Crude market

- OPEC and non-OPEC members will be meeting on April 17th for follow up discussion on last month’s production freeze decision.

- Barclays has warned that recent commodities rally isn’t riding on fundamental improvements and it could easily deteriorate if investors rush for exit.

- Hedge funds have been main driver of the rally as they build long positions.

- IEA in its latest report cited initiative and weaker Dollar behind oil rally suggested that price may have bottomed.

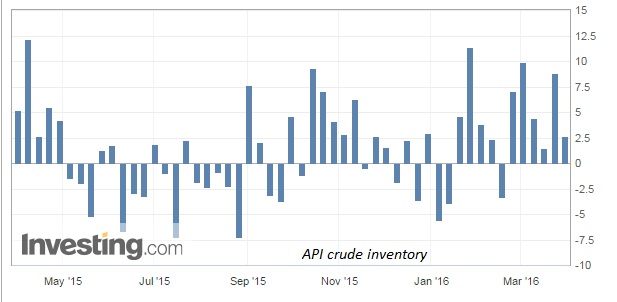

- American Petroleum Institute’s (API) weekly report showed inventory rose by 2.6 million barrels.

Today’s inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Chart courtesy investing.com

Trade idea

- While downside risks were higher for oil, WTI has reached our upside target around $41-42 area. We previously recommended 60% profit booking. We now suggest full profit booking and wait for the next indication for big upside gains.

- Instead we recommend now, small position building in the short side.

- Sell WTI at current price $39/barrel with stop loss around $42/barrel and target around $34 and $32/barrel.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX