WTI showing strength as it consolidates around $34 key resistance area.

Key factors at play in Crude market -

- Russian oil minister, Alexander Novak said freeze production will succeed even without Iran as 75% of the producers are in the camp.

- Key meeting to be held in mid-March.

- With US lawmakers passing bill to lift 40 year old ban on US crude export this year and US crude has reached Europe. Supply is expected to rise 4.1 million barrels/day over the next five years.

- Latest IEA report shows, supply glut likely to persist through 2017 and shocks may only come at the end of decade.

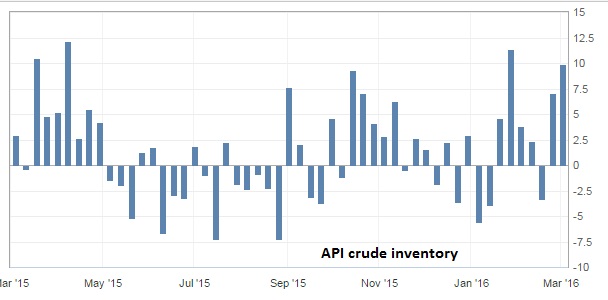

- American Petroleum Institute's (API) weekly report showed inventory rose sharply by 9.9 million barrels. In past two weeks, inventory rose by 17 million barrels.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future. IEA report confirmed this view.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:30 GMT.

Chart courtesy investing.com

Trade idea -

- We don't expect major recovery in oil price as global inventory is too large for that to work even with production freeze.

- While we are still committed to the downside, our ultra-short term call for Crude to reach $41/barrel is still on. Stop loss revised at $29.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX