Crude oil (WTI) after breaking its consolidation sharply headed higher but sellers were large around 200 day moving average around $51/barrel area. WTI has taken a sharp turn to trade at $46/barrel as of now.

Key factors at play in Crude market -

- Crude oil production is declining for high cost producers, such as shale gas but still not an alarming rate.

- However due to new technologies, crude oil production cost has declined for shale producers.

- OPEC and IEA expects non-OPEC supply to decline both is year and next.

- Goldman Sachs has recently cut its forecast for WTI to $38/barrel in within one month.

- Almost all investment bank sees price to remain low but rise through next year.

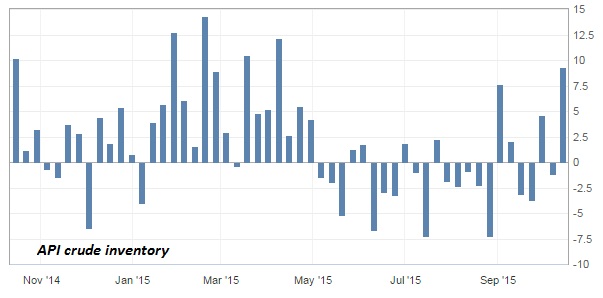

- American Petroleum Institute's (API) weekly report showed inventory surplus by 9.3 million barrels.

- However lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:00 GMT.

Trade idea -

- WTI has fallen sharply from $51/barrel area recently, however that is not prompting to change short term bullish outlook, but posing as an opportunity to buy lower.

- Two immediate target for WTI stands at $53.6/barrel and $55.6/barrel, while $69/barrel with stop around $37/barrel is a bit longer term. WTI is currently trading at $46/barrel. $43/barrel is the stop loss area for first two targets.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate