As of now, WTI is up 85% from its February low and still continuing. It is currently trading at $48.1 /barrel, looking to challenge resistance around $49/barrel, which is coinciding with $50 psychological resistance.

Key factors at play in Crude market –

- Wildfire has led to shut down of 1.8 million barrels/day production in Alberta, Canada.

- Severe outages in Nigeria, Libya and production halt in Venezuela has taken out another 1.5 million barrels/day supply.

- U.S. oil production has dropped to 8.8 million barrels/day.

- Major supply increase is taking place from Middle East. Iran boosted exports by 600,000 barrels/day. Saudi Arabia is expected to increase production to 11 million barrels/day.

- Saudi Prince Mohammad bin Salman, who is Kingdom’s new strongman has laid out a plan to diversify Saudi Arabia from oil. Plan is named Saudi Vision 2030. It will increase non-oil revenue to Real 1 trillion by 2030 from current 163 billion.

- China’s stimulus may also be providing some support to oil.

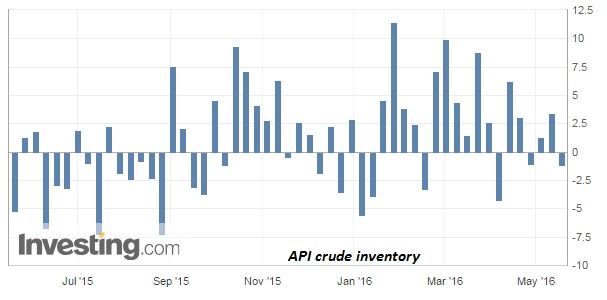

- American Petroleum Institute’s (API) weekly report showed inventory decline by 1.14 million barrels.

Today’s inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Chart courtesy investing.com

Trade idea –

- We expect current rally to increase further, however oil price is likely to low over much longer horizon.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022