WTI is down for second consecutive week. It is currently trading at $44.1/barrel.

Key factors at play in Crude market –

- Saudi Arabia replaced its two decades old oil minister Ali al-Naimi with Mr. Falih, chairman of Saudi Aramco.

- Saudi Aramco will significantly increase production over the coming weeks. Production at country’s Shaybah oil field will rise 33% to 1 million barrels/day.

- Wildfire in Canada disrupted production at oil sand, supporting price.

- Oil price has gained ignoring Doha talks failure among major global producers to freeze production but got spooked by April production number from OPEC, which showed Cartel’s production reached 33.2 million barrels per day, biggest since 1989.

- Iran production saw sharp increase by 484,000 barrels per day.

- Saudi Prince Mohammad bin Salman, who is Kingdom’s new strongman has laid out a plan to diversify Saudi Arabia from oil. Plan is named Saudi Vision 2030. It will increase non-oil revenue to Real 1 trillion by 2030 from current 163 billion.

- China’s stimulus and commodity frenzy might also be providing some support to oil.

- American Petroleum Institute’s (API) weekly report showed inventory decline by 3.45 million barrels.

Today’s inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

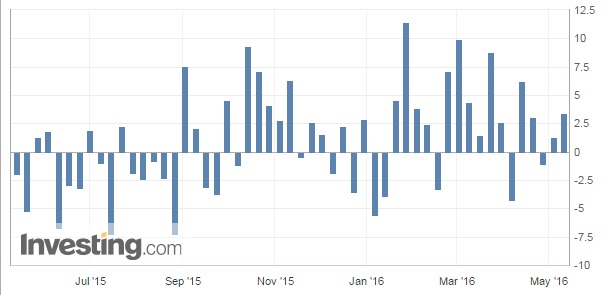

Chart courtesy investing.com

Trade idea –

- WTI weakness likely to persist further for at least another week. Price rise likely to face supply rise hurdle.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022