Crude oil (WTI) has broken above its triangular consolidation suggesting further rise.

Key factors at play in Crude market

- Crude oil production is declining for high cost producers, such as shale gas but still not an alarming rate.

- OPEC has suggested sharp drop in non-OPEC supply by 1 million barrels by 2017 to 58.2 million barrels /day.

- Goldman Sachs has recently cut its forecast for WTI to $38/barrel in next one month.

- Almost all investment bank sees price to remain low but rise through next year.

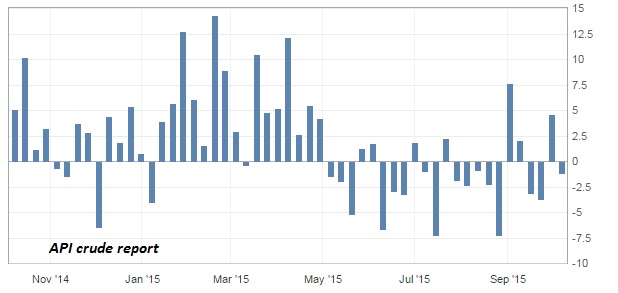

- American Petroleum Institute's (API) weekly report showed inventory decline by 1.2 million barrels.

- However lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Trade idea

- WTI has broken above its key triangular congestion, suggesting further rise in prices. Yesterday gained massive to $49/barrel after clearing the falling trend line at $46.5/barrel.

- Two immediate target for WTI stands at $53.6/barrel and $55.6/barrel, while $69/barrel with stop around $37/barrel is a bit longer term. WTI is currently trading at $49.3/barrel.