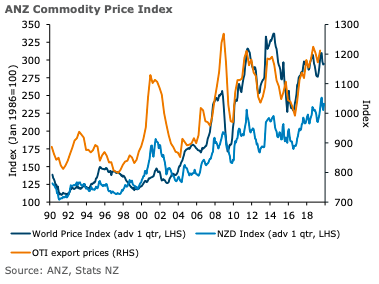

The ANZ’s World Commodity Price Index lifted 0.3 percent m/m in August following two months of weaker prices. Dairy and forestry sectors lifted in August but this was largely offset by weaker prices for meat and aluminium.

The index has gained 0.9 percent in the past year. In local currency terms the index lifted 3.9 percent m/m, bolstered by the 2.1 percent fall I the New Zealand dollar Trade Weighted Index during August.

Shipping costs were firmer in August despite concerns of slowing global trade as the trade war between China and the United States escalates. The Baltic Dry Index lifted 27 percent during August to reach its highest level in almost nine years.

The supply of ships is reducing as owners dock ships to make alterations to meet the tighter environmental regulations that will be imposed next year. Dairy prices gained 1.3 percent in August, reversing the weakness seen the previous month.

Milk powder prices firmed but butter prices softened. Dairy prices are currently bumping along but are yet to show the upward trend that slowing global growth in milk supply suggests is due. However, aluminium prices fell 3.1 percent in August after gaining 2.4 percent in July. The price of this metal has been bouncing along for some time.

Recent tightening of production in China pushed up the aluminium price within that market but prices elsewhere remain subdued as concerns grow about weakening global economic conditions.

"We are forecasting further downward currency movement in the coming months, supporting returns to New Zealand producers," ANZ Research further commented in the report.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility