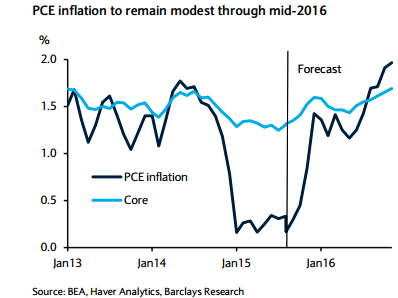

The Federal Reserve committee retains its data-dependent stance and a softer inflation profile might be a reason to delay the first rate hike into 2016.

Although the stabilization in oil prices should lead headline inflation to rebound early next year, recent dollar appreciation and ongoing declines in Chinese producer prices should lead to a moderation in tradable goods inflation through mid-2016.

"Thus, the nascent firming is seen in core inflation as giving way to further softness. In addition, the recent fiscal agreement calls for a further reduction in Medicare reimbursement rates, which is likely to keep the wedge between CPI and PCE inflation wide by historical standards", says Barclays.

A softer inflation outlook lies ahead for US

Monday, November 2, 2015 5:26 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX