Despite the abrupt upswings in NZDUSD, in short run, we target 0.70, based on an assumption the Fed would hike in Dec and the RBNZ will cut in November. However the persistent backdrop of global demand for high-yielding currencies is strong - if the Fed doesn’t hike, then 0.75+ is likely instead. As a result of the topsy-turvy swings, we reckon option strips with diagonal tenors would serve as the ideal hedging instrument.

On the data front, Q3 NZ CPI release and the GDT dairy auction (Tue) would be the close focus.

High real rates and improvement in dairy prices will sustain NZD strength for a while, but not forever. The reduction in the product on offer would likely to support dairy prices.

Still high real short rates and rising dairy prices have supported NZD, but we remain bearish given looming policy catalysts.

Greater clarity around the New Zealand policy backdrop – more easing and tougher macro-prudential arrangements which should bias the neutral rate lower in New Zealand over time – will open up genuine downside for NZD moving into 2017.

The Q4’16 forecasts are at 0.70, with Q2’17 at 0.66.

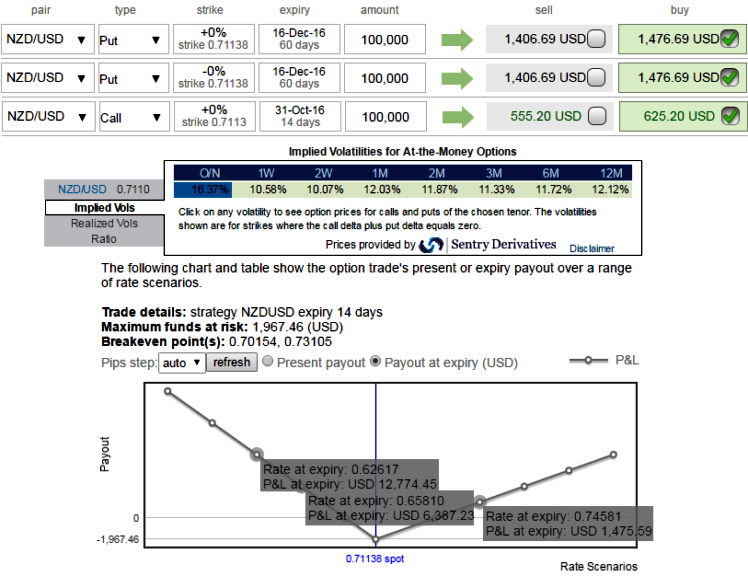

NZD OTC market functions perceive higher IVs contemplating above data events in this week (the current IVs are at 16.37%), while RBNZ’s rate cut in its monetary policy by 25 bps is an extra impetus.

As a result of this speculation in the FX market, the New Zealand dollar moved lower sensing more bearish pressures in the weeks to come especially after data showed that China’s imports dropped far more than expected last month and as the greenback remained supported by Friday’s strong U.S. jobs data.

Well, to mitigate this FX risk, at spot reference 0.7113 we reckon the NZDUSD options strips with narrowed strikes as shown in the diagram on higher IV skews. These skews in 1W IVs signifies the OTC market interests in OTM put strikes.

Even if the underlying spot goes against our anticipation, the underlying risk is properly mitigated regardless of swings. As you can probably understand from the payoff function, the strategy can also be utilized on speculating grounds as it is likely to fetch certain yields regardless of swings (both short-term upswings and long term bearish risks).

Hence, we advocate initiating longs in 2 lots of 2m -0.49 delta put options, while buying 1 lot of +0.51 delta calls of 2w expiry.

Please be noted that the strikes and tenors as shown in the diagram are just for the demonstration purpose only, use the key inputs of the strategy as per your requirements and exposure.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal