Last night’s FOMC minutes for September did little to change the market’s expectations for upcoming policy meetings.

The implied probability of a 25bp hike from the Fed in November and December remain close to 20% and 70% respectively.

Our base case remains for a hike in December.

Today’s BoE governor Carney’s speech would be factored in rate cut hopes if UK construction figures for August presents the final piece of official ‘hard’ output data in advance of the preliminary estimate of Q3 GDP.

Based on the flow of relevant data as a whole, our bean count so far suggests Q3 GDP growth of 0.4% QoQ, well ahead of the BoE’s assumptions from the August Inflation Report.

Meanwhile, US September retail sales are likely to retrace some of the softness last month, helped by strong car sales. We look for a rise of 0.6% in line with the market consensus. Preliminary US October consumer sentiment is expected to rise for the second month.

For today, the market focus would fall on appearances from BoE Governor Carney and Fed Chair Yellen’s speech.

OTC Outlook and FX Option Strategy:

The rationale: Use upswings to deploy “credit put spreads” as the chances of the retest of recent lows of 1.2089 is quite a possible event.

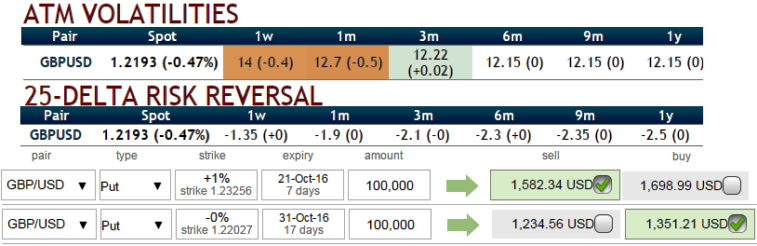

Upside potential is limited in the short run as you can see bullish neutral risk reversals in 1w expiry with negative sentiments in OTC over long-term tenors and this should be cushioned & used for shorts during reducing volatility times.

The 1w ATM implied volatility is up about 14% and likely to perceive at 12.7% in 1m tenors.

Well, any abrupt upswings should not be panicky, instead deploy them in the below option strategy.

Execution: Keeping risk reversal, IV and trend factors in mind, it is advisable to go long in 1m ATM -0.49 delta put while writing 1W (1%) ITM put with positive theta and delta closer to zero (both sides use European style options).

Add longs to favor major downtrend, dips should optimally be utilized so as to participate in that major trend, while deploying ITM short puts capitalizing short-term upswings. Thereby, the profitability can be maximized for every shift towards downside and this is not the same on the upside.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices