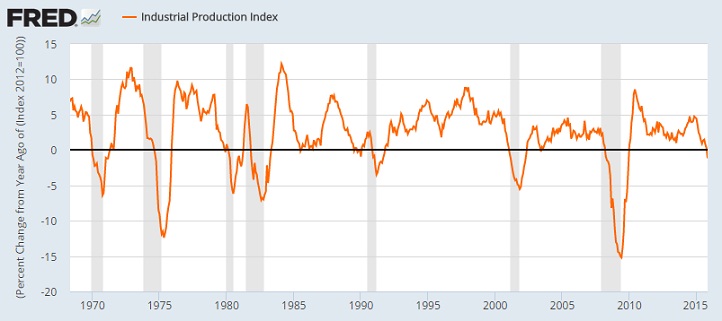

US Federal Reserve hiked rates last week, being confident over US economy and growth ahead. However Industrial production in US may not be in agreement with the FED.

This yearly growth chart of Industrial production index (base year 2012 at 100) is enough to make investors worry over US economy. A recession might be impending.

In November, 2015 yearly growth in Industrial production has fallen to -1.17%, lowest level during the 2008/09 crisis era. However that is hardly the worrying part.

For last 45 years and more, 11 odd times, yearly growth in Industrial production in US has fallen to negative and except for three occasions (1985, 1989 and 2003), they have been accompanies by recessions. And in none of those three occasions, IP growth has dropped to such levels.

So if Recession doesn't accompany this drop in IP, it would be unprecedented.

Naturally this drop isn't a guarantee of upcoming recession but if history is of any guide, it surely calls to be extra vigilant and cautiousheading into 2016.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed