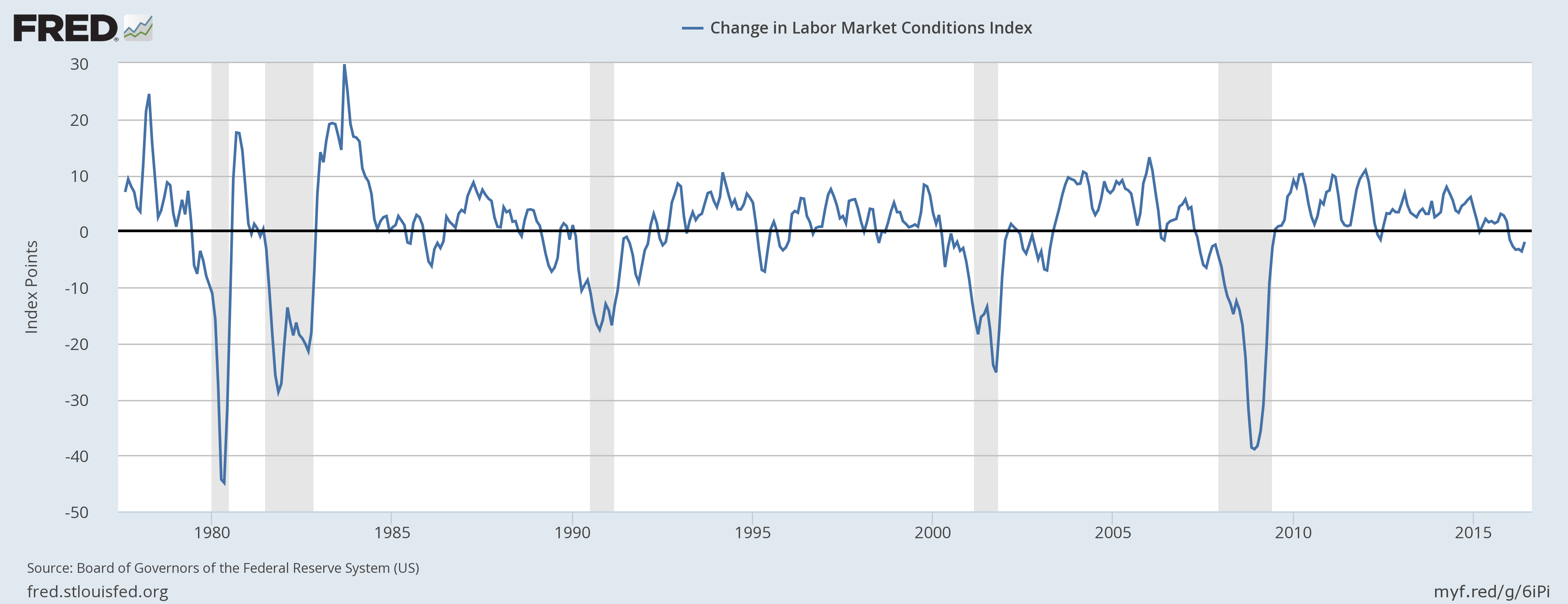

Labor market condition index (LMCI) that was developed by the U.S. Federal Reserve in 2014 to better track the conditions prevailing in the U.S. labor market is sending worrying signals. The LMCI is derived from a dynamic factor model that extracts the primary common variation from 19 labor market indicators. This year the index has been pretty weak.

In January 2016, LMCI has declined to negative territory and hasn’t been in the positive since. In May it bottomed at -3.6, the worst reading since the 2008/09 crisis.

The index since 1977 (back calculated using data) has dropped to negative 12 times (including the current) and in 8 cases it has been for long (more than 6 months) and deep. And in 5 instances among these 7 (excluding the current) the drop has been followed by deep recession.

LMCI became of the many indicators that have been warning the possibility of a recession in the United States. Focus is on today's payroll data to see what it points to - recovery or recession.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal