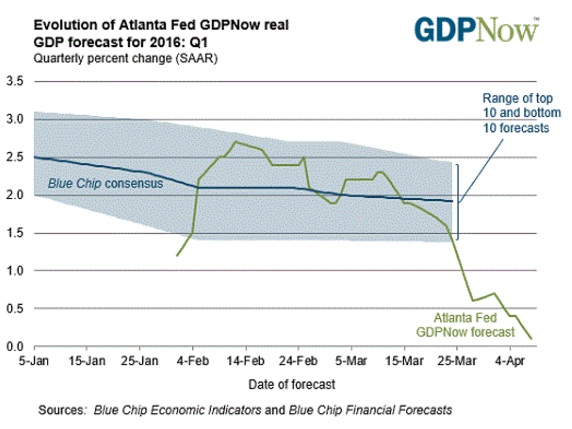

Just 2 months ago, Atlanta FED’s GDP forecast model was predicting 2.5% annualized growth for first quarter in United States. By March second week model growth dropped to 2.3%, but after that it started declining sharply and by April 5th, measure was pointing to just 0.4% growth and last Friday that growth declined to just 0.1%.

Atlanta FED’s model is then just pointing that U.S. Economy is on the brink of a recession. If it comes true, then that complicates thing.

U.S. Federal Reserve is looking to hike rates as early as June and a recession in first quarter may put an end to that ambition. As of now, FED is planning to hike twice this year, while market is predicting just one hike of 25 basis points. If a recession hits in first quarter then market may once again be right in their prediction and FED will have to approach more cautiously.

However only piece of good news is that U.S. economy has traditionally and historically has underperformed in first quarter, which is followed by strong recovery in second and third quarter. So focus will be on next release of ‘GDP Now’, which will be on April 13th.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target