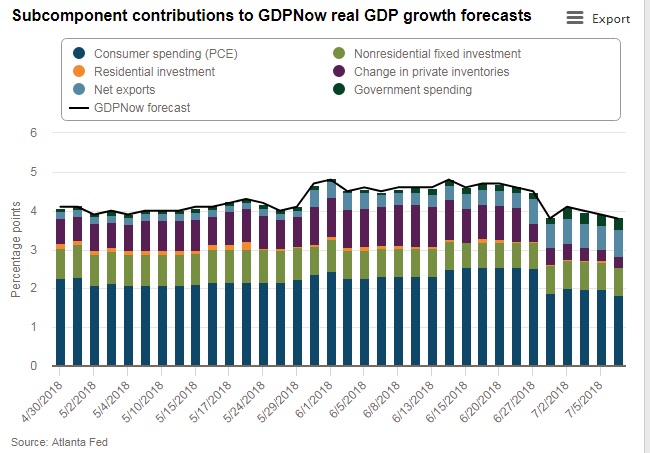

The ‘GDP Now’ data published by the Federal Reserve of Atlanta is posing some concerns over the health of the U.S. economy and more importantly, the effect of the current trade feud on the economy. In mid-June, Atlanta Fed’s GDP Now was forecasting a U.S. economic growth 4.8 percent in the second quarter of this year. It even prompted the Commerce Secretary Wilbur Ross in suggesting while speaking to CNBC that the growth rate will be over 3 percent on an annualized basis and even close to 4 percent.

However, since then the GDP Now has projected a sharp decline in growth. As of latest reading published last week, GDP Now is projecting 3.8 percent growth in the second quarter; not too impressive and most important, down almost a percent.

The major reasons for the slowdown have been a decline and in consumer spending growth and second-quarter real gross private domestic investment growth. Since mid-June, consumer spending has declined by 0.7 percent and private investment growth has slowed to just 6 percent from well over 7 percent.

It can be said that the uncertainties surrounding trade and tariffs are taking its toll on the economy.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility