The asset purchase program introduced by the European Central Bank (ECB) back in 2015 and extended earlier this year is about to end in March next year. The central bank is currently purchasing €80 billion worth of bonds per month and it is widely expected that over the next meetings, the central bank would announce an extension to the program. Yet some analysts remain skeptical of such a move as the current purchase rate is already posing concerns in some of the bond markets as ECB is failing to meet the key capital ratio.

The key capital ratio is the ratio of monetary equity each National Central Bank hold with the European Central Bank. For example, German Bundes bank holds 18 percent of the total capital at the ECB, Banque de France’s share is 14.2 percent. According to the rules, the ECB would purchase bonds from all across the Eurozone in accordance to the capital subscription ratio or the key capital ratio.

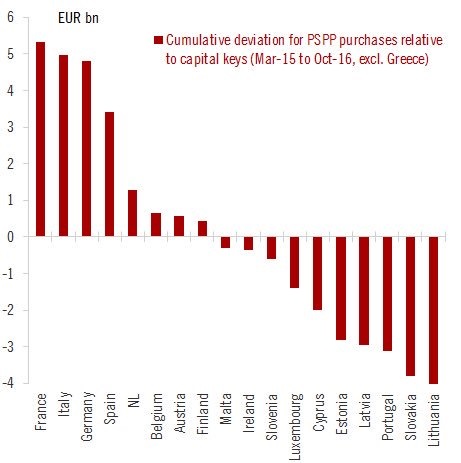

However, the shortage of eligible bonds has already forced the European Central bank to deviate from this target. The above chart shows that this deviation runs in billions of dollar. For example, the European Central Bank (ECB) has bought more than €5 billion worth of bonds in excess of the capital subscription target for France; similarly a €13 billion cumulative deviation for Italy, Germany, and Spain. It has under purchased bonds of smaller countries like Lithuania, Slovakia, Portugal, and more.

If scarcity is a critical issue, the ECB would have to change some rules for these smaller countries before it promises more asset purchases or the deviation would worsen further.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence