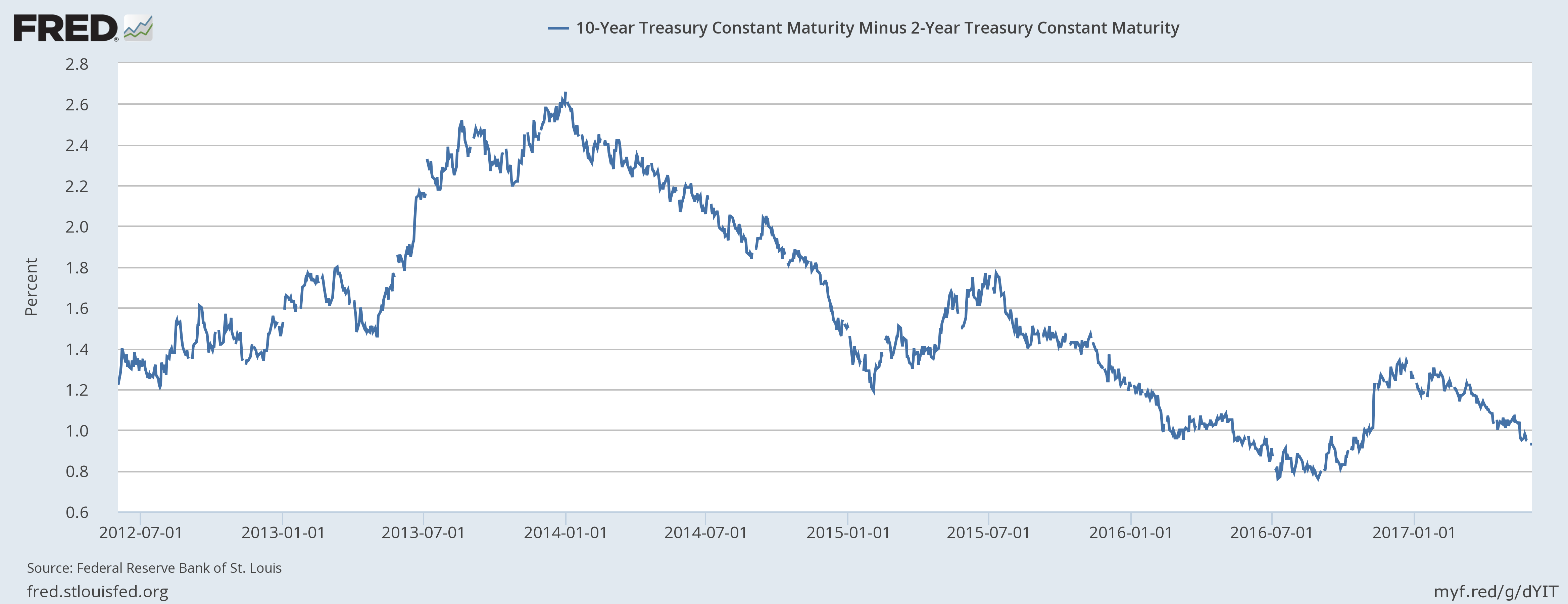

After President Donald Trump’s victory last November, the U.S. yield curve steepened sharply in anticipation of faster rate hikes by the U.S. Federal Reserve as traders anticipated higher inflation in the United States thanks to President Trump’s promise of increased infrastructure spending along with tax reforms and tax cuts. The gap between the U.S. 2-year Treasury yield and the 10-year Treasury yield jumped from just 100 basis points on November 8th to 133 basis points by December last year.

However, as Donald Trump Presidency remained dogged by controversies with related to Russia’s interference in the US election and high profile leaks aimed to undermine the current administration, traders have started pricing a slower path for President Trump’s promises through Congress. Moreover, the Democrats remain committed to undermining and voting down all of President’s agendas including the selection of his cabinet members. They are working to delay the selection of cabinet members as much as possible.

The recent weakness in the economic numbers has also contributed to the decline. Last Friday, non-farm payroll report showed that the U.S. economy added just about 138,000 jobs in the month of May, much lower than anticipated by the market and economists. The yield gap between the 10-year Treasury and the 2-year Treasury, which is often seen as a measure of duration risk linked to inflation and hike expectations has now declined to just 93 basis points, as of June 2nd, which is the weakest point since last October, marking an end of the ‘Trumpflation’ trade.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says