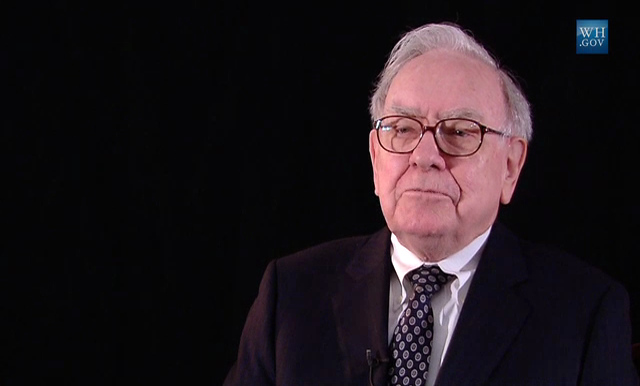

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway (NYSE: BRK.A), announced on May 3 that he will step down at the end of the year, marking the end of a historic six-decade leadership run. At 94, Buffett told The Wall Street Journal that age finally caught up with him, although there wasn’t a specific moment that triggered the decision.

“How do you know the day you become old?” Buffett mused, adding he didn’t truly feel his age until around 90. He noted increasing difficulties with balance and occasional trouble recalling names, signs he could no longer ignore.

During the final minutes of this year’s Berkshire Hathaway annual meeting, Buffett named Vice Chairman Greg Abel as his successor. He praised Abel’s exceptional leadership skills and effectiveness in daily operations, stating, “He’s just so much more effective at getting things done.”

Buffett emphasized that it would be unfair to delay the transition any further. “The more years that Berkshire gets out of Greg, the better,” he said. While stepping down as CEO, Buffett assured shareholders that his investment insight remains intact, especially in volatile markets. “If there’s a panic, I don’t get fearful when prices fall. I can still be useful.”

As Berkshire Hathaway manages a staggering $348 billion in cash reserves, Buffett expressed confidence in Abel’s vision for future investments, noting, “Abel will have ideas about where money should be invested.”

Buffett’s departure signals a new chapter for the conglomerate, yet his legacy as the “Oracle of Omaha” remains deeply rooted in the company’s DNA. Investors worldwide will closely watch how Abel steers Berkshire in the post-Buffett era.

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate