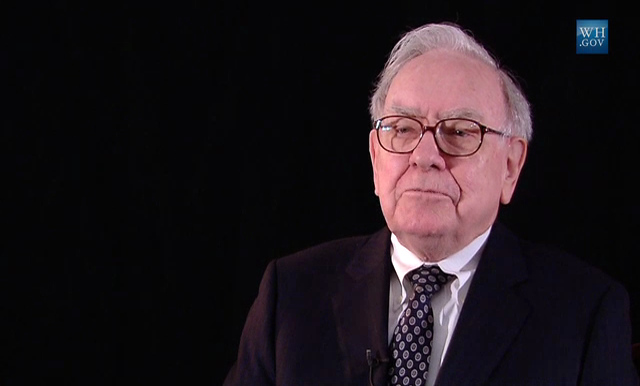

Warren Buffett has donated $6 billion worth of Berkshire Hathaway (NYSE: BRKa) stock to charitable foundations, marking his largest annual donation since he began philanthropic giving in 2006. The legendary investor gifted approximately 12.36 million Berkshire Class B shares, raising his total lifetime donations to over $60 billion.

The Gates Foundation received the largest portion with 9.43 million shares, while the Susan Thompson Buffett Foundation was granted 943,384 shares. Additionally, 660,366 shares each went to foundations run by his three children: the Howard G. Buffett Foundation, the Sherwood Foundation, and the NoVo Foundation.

Despite the latest donation, Buffett still holds 13.8% of Berkshire Hathaway shares. Prior to the donation, his net worth stood at $152 billion, placing him fifth on Forbes’ list of the world’s richest individuals. After the donation, he is expected to rank sixth.

Buffett, 94, has led Omaha-based Berkshire Hathaway since 1965. The $1.05 trillion conglomerate owns nearly 200 businesses, including Geico and BNSF Railway, and holds major stakes in companies like Apple (NASDAQ: AAPL) and American Express (NYSE: AXP).

In 2023, Buffett revised his will to allocate 99.5% of his remaining wealth to a charitable trust overseen by his children—Susie (71), Howard (70), and Peter (67)—who must unanimously decide how to distribute the funds within a decade of his passing.

The Susan Thompson Buffett Foundation focuses on reproductive health, while the Sherwood Foundation supports Nebraska-based nonprofits. The Howard G. Buffett Foundation addresses hunger, human trafficking, and conflict mitigation. The NoVo Foundation works with marginalized women and indigenous communities.

Buffett reaffirmed he has no plans to sell any Berkshire shares and noted that contributions to the Gates Foundation will cease upon his death.

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies