Slowdown in Chinese economy has created havoc for commodities across world and its producers.

Naturally a though has occurred -

After two years of sharp slowdown and currency market adjustment, question arises hasn't the market priced in China weakness already.

- What I mean is, Chinese economy has slowed down to 7% from double digit growth just few years back and it is expected to continue to slow down in the foreseeable future.

- Given such fundamentals, Commodities have fallen sharply, say energy for which price has fallen close to 60% from its peak in 2014.

- Currencies both across emerging markets as well as developed market have adjusted significantly over this concern, for example New Zealand Dollar is down close to 19% this year so far, while South African Rand is down close to 28% in past one year.

So how likely is further devaluation both in commodities and currencies, which are dependent on China?

Very much...if China slows down further and sharply.

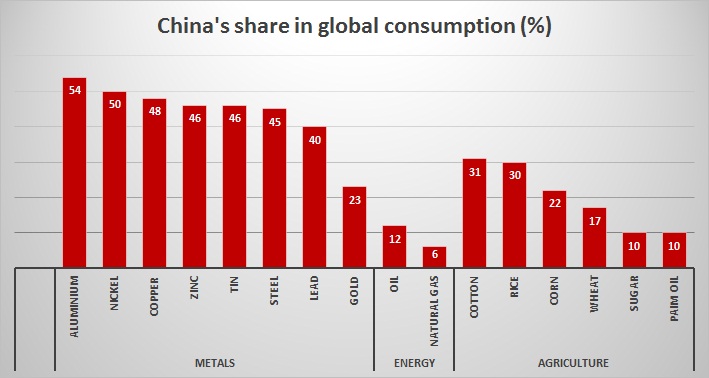

Because when it comes to commodities, China is still the glutton.

As of 2014,

Metals -

- China is consuming significant portion of world production of Aluminium (54%), Nickel (50%), Copper (48%), Zinc (46%), Tin (46%), Steel (45%), Lead (40%), and Gold (23%).

Energy -

- China is still not the largest consumer of energy products but raising consumption in both oil (12%) and natural gas (6%).

Agriculture -

- Not as large as industrials, nevertheless significantly large enough in Cotton (31%), Rice (30%), Corn (22%), Wheat (17%), Sugar (10%), and Palm oil (10%).

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand