Uniswap decentralized cryptocurrency exchange previously introduced its v4's Know Your Customer (KYC) hook for decentralized finance protocol. This is a type of hook for verification on Uniswap's v4 pools.

However, this v4 KYC hook immediately stirred controversies as the crypto community debated the future of DeFi. The new hook is already available on an open-source directory for Uniswap V4 hooks, but apparently, the response from the crypto sector showed many are against the technology.

Criticisms for Uniswap's KYC Hook

According to CoinTelegraph, many people took to social media to express their irritations over the hook. One commented that this only allows decentralized finance protocols to be whitelisted by regulators because it authorizes users to be checked for KYC before they can trade on a pool.

Financial regulators typically apply KYC procedures to verify customers' identities. The main purpose of this KYC is to identify any money laundering and financial activities of terrorist groups. The crypto community targeted Uniswap because it developed the KYC hook of its V4 directory as an opt-in functionality.

"Seems like you do not understand how this works. #1 It is lp specific and some projects may want to operate within the legal confines of jurisdiction," one of the comments reads. "#2 hooks can be made by community devs. You're trashing something that has done more than anyone else for 'real defi.'"

Why The Community is Against Unisap's v4 Hook

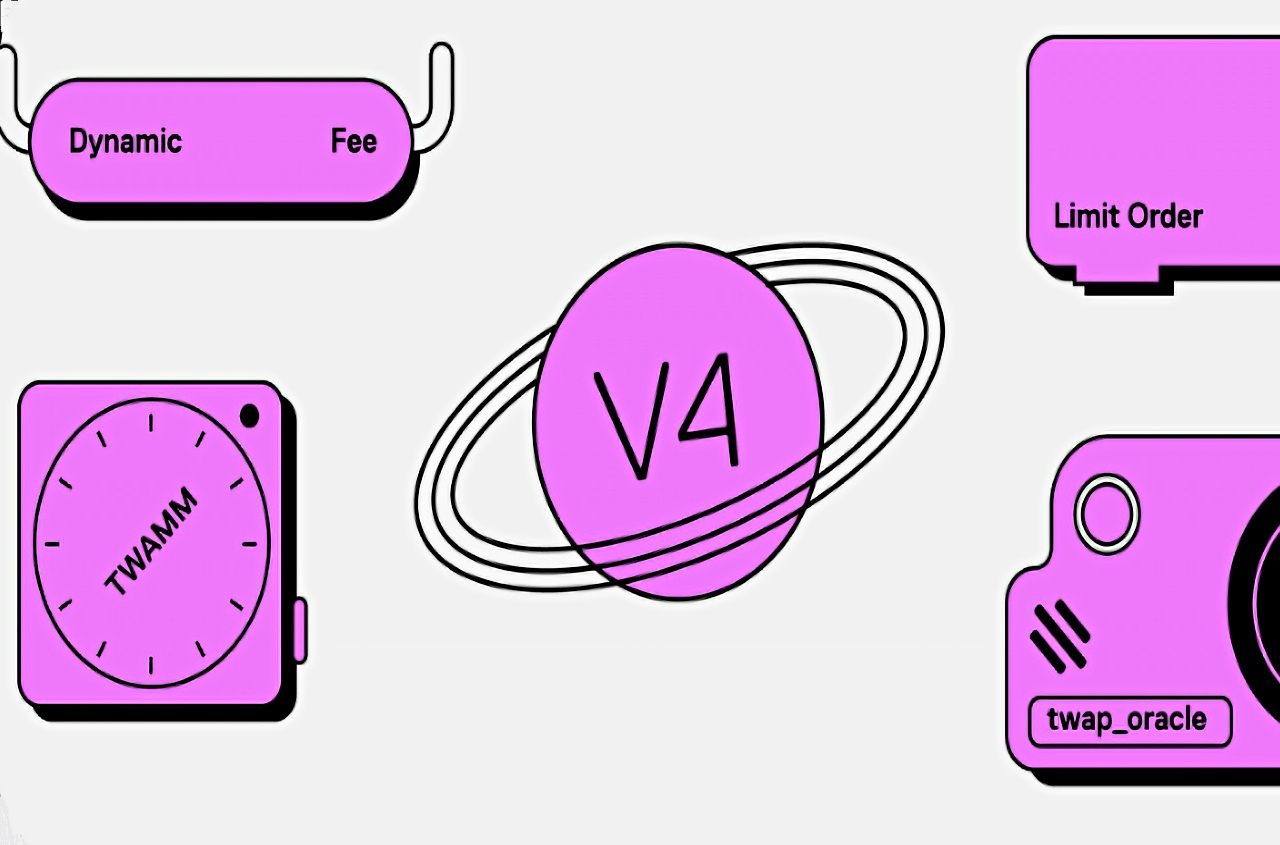

A hook is a tool that enables developers to modify a code without changing the main formation of the program. In the case of Uniswap V4, this hook tool allows developers to utilize KYC authentication in the DeFi protocol.

Crypto News reported that Uniswap's KYC hooks featured in its V4 update. The company's decision to integrate these hooks in its V4 update surprised many people in the crypto community as this feature will allow US-based liquidity pools to request KYC and Whitelist applications from users who would like to join the pool.

Photo by: Uniswap Blog

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War

Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War  Reliance Industries Surges on Strong Quarterly Profit, Retail Recovery

Reliance Industries Surges on Strong Quarterly Profit, Retail Recovery  Investors Brace for Market Moves as Trump Begins Second Term

Investors Brace for Market Moves as Trump Begins Second Term  U.S. Stock Futures Rise as Trump Takes Office, Corporate Earnings Awaited

U.S. Stock Futures Rise as Trump Takes Office, Corporate Earnings Awaited  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Why the Middle East is being left behind by global climate finance plans

Why the Middle East is being left behind by global climate finance plans  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation

Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary