The U.S. unemployment rate has surged to its highest level since October 2021, reaching 4.3% under the Biden-Harris administration, according to the latest report from the Labor Department. This development marks a significant economic challenge for the current administration as it navigates a complex landscape of post-pandemic recovery and economic policy adjustments.

The Labor Department's report, released earlier today, underscores a troubling trend in the labor market. The 4.3% unemployment rate reflects an increase in joblessness, posing critical questions about the effectiveness of the administration's economic strategies. The rise in unemployment comes amid broader concerns about inflation, wage stagnation, and the overall health of the U.S. economy.

Economic analysts point to several factors contributing to the uptick in unemployment. Persistent supply chain disruptions, ongoing global economic uncertainty, and shifts in consumer behavior are among the key drivers. Additionally, the labor market is experiencing structural changes, with industries such as technology and retail undergoing significant transformations that impact employment levels.

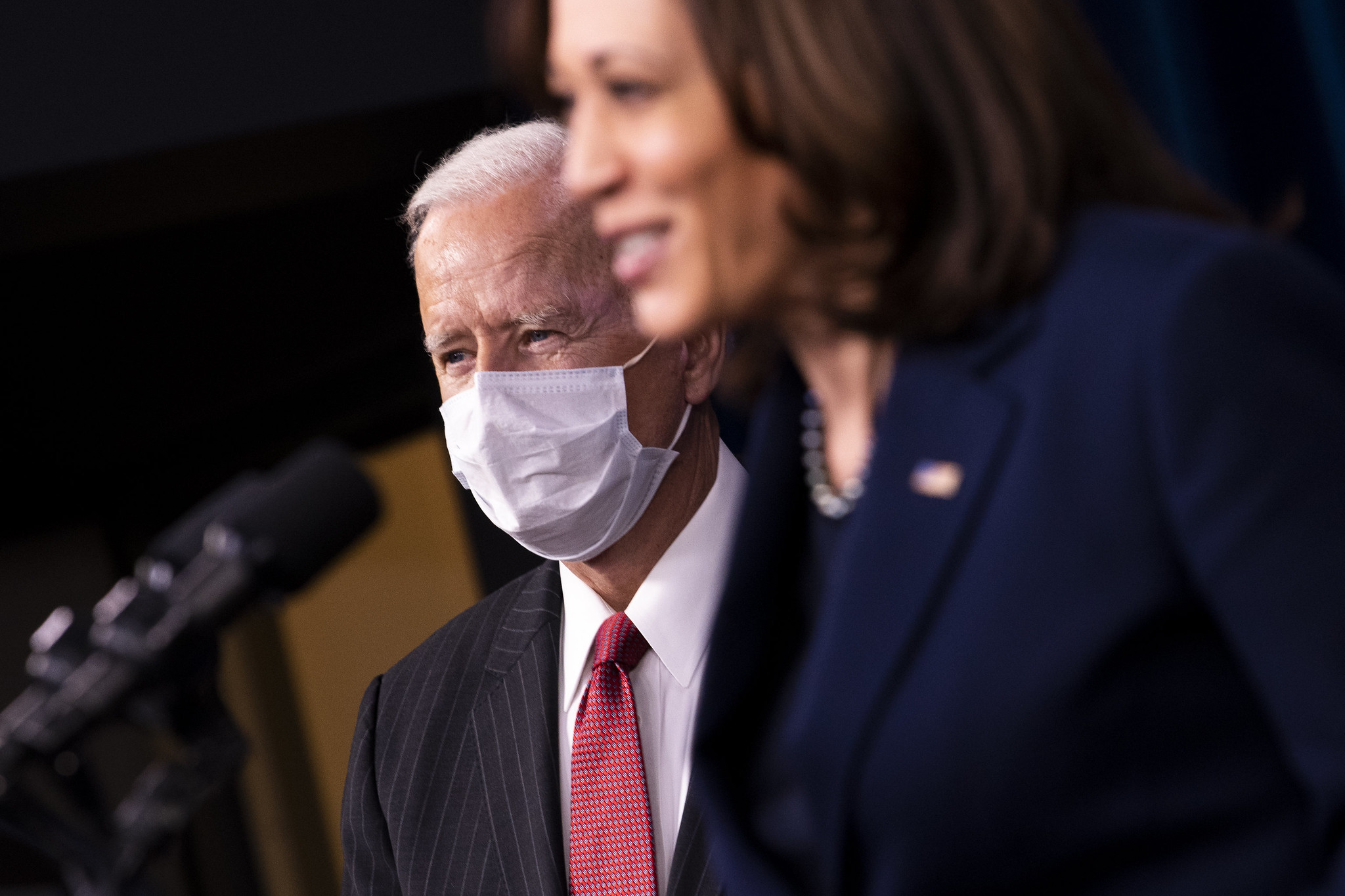

President Joe Biden and Vice President Kamala Harris have emphasized their commitment to economic recovery and job creation since taking office. However, the recent unemployment figures present a formidable obstacle to their goals. The administration's initiatives, including the American Rescue Plan and various infrastructure investments, are designed to stimulate job growth and support economic stability. Despite these efforts, the current data suggests more work is needed to achieve sustained employment improvements.

The political ramifications of rising unemployment are substantial. Critics of the administration argue that the current economic policies are insufficient to address the complexities of the modern labor market. They point to regulatory burdens and fiscal policies that they claim stifle business growth and job creation. On the other hand, supporters argue that the administration's measures are necessary to address long-standing economic inequalities and to invest in the nation's future prosperity.

In response to the Labor Department's report, the administration has reiterated its focus on advancing policies aimed at economic resilience. This includes continued investment in infrastructure, education, and technology to foster a more adaptable and competitive workforce. Additionally, efforts to address supply chain issues and support small businesses are being highlighted as crucial components of the administration's strategy.

The latest unemployment figures also have significant implications for upcoming elections. Economic performance is a critical factor in voters' decision-making processes, and the administration's handling of employment issues will likely be a focal point in political campaigns. Both Democratic and Republican candidates are expected to leverage the unemployment data to bolster their respective positions on economic policy.

As the administration grapples with the rising unemployment rate, it faces the challenge of balancing short-term relief measures with long-term economic planning. The path forward requires navigating a complex interplay of domestic and global economic forces, while also addressing the immediate needs of American workers and businesses.

The 4.3% unemployment rate serves as a stark reminder of the ongoing economic challenges facing the nation. As the Biden-Harris administration continues to implement its economic agenda, the effectiveness of these policies will be closely scrutinized in the months ahead. The administration's ability to foster job growth and economic stability will be pivotal in shaping the nation's economic future.

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off