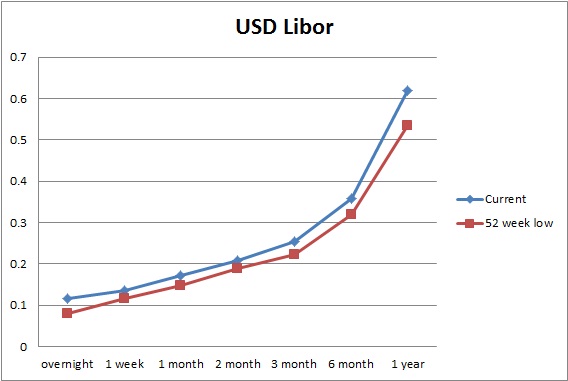

- Dollar denominated interest rates have risen over the last year in anticipation of a rate rise in the US. Federal Reserve so far is not expected to disappoint the market. Rise in economic activity suggests that the economy is strong enough to handle rate hikes.

- The current communications suggest a rate hike sometime in June 2015. Despite the strengthening of the rates, gap exists between the expectation of market and FOMC participants over its rise.

- It would be fair to say that the FED has achieved a very high credibility and so far has kept its commitment straight and fulfilled.

- So, if the FED is going to hike in June the rates could rise further. It is extraordinary to notice how the Forward guidance has become a policy tool deeply entrenched in market psychology and valuing the commitments of central banks.

- Economic dockets from US also showed better resilience than many assumed. Most of time last year beat the estimates.

In view of strong US economy and high credibility of FED, the libor rates are to strengthen further in the coming months despite the fall in oil price inflation.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary