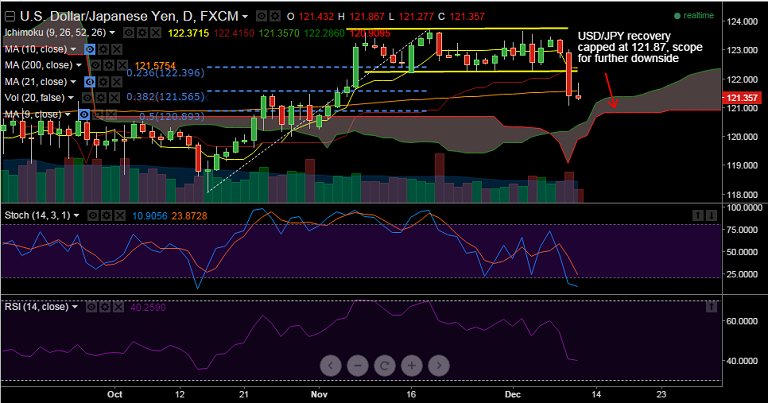

USD/JPY posting a modest recovery from an almost 200 pips slump in Wednesday's trade. The pair broke below 200 DMA and 38.2% of the Oct-Nov rise at 121.56.

- Upward revision to Japan Q3 real GDP and the machinery orders data released yesterday suggest that the BOJ can persist with its current stance for now, and the Yen remained supported by the reduced BOJ easing expectations.

- Bargain-hunting at lows and option-related buys saw a bounce to 121.87, but price was rejected at highs and the pair is now back to 121.53.

- Current slide may extend upto daily Cloud, pair could test prior lows in 120.00 levels, with 121.27 (Session lows) initial support, 121.57 (200-DMA) resistance.

- Beyond that there is limited scope for further yen weakness, and going into the FOMC meeting next week means USD/JPY is likely to remain well supported.

- For now we find it good to sell rallies around 121.80, SL: 122.40, TP1: 121.10, TP2: 120.90

Resistance Levels:

R1: 121.57 (200-DMA)

R2: 121.60 (Daily High Oct 26)

R3: 123.05 (Session High Dec 9)

Support Levels:

S1: 121.27 (Session lows Dec 10)

S2: 121.00 (Daily Low Nov 4)

S3: 120.92 (50% 118.07-123.77 rise)