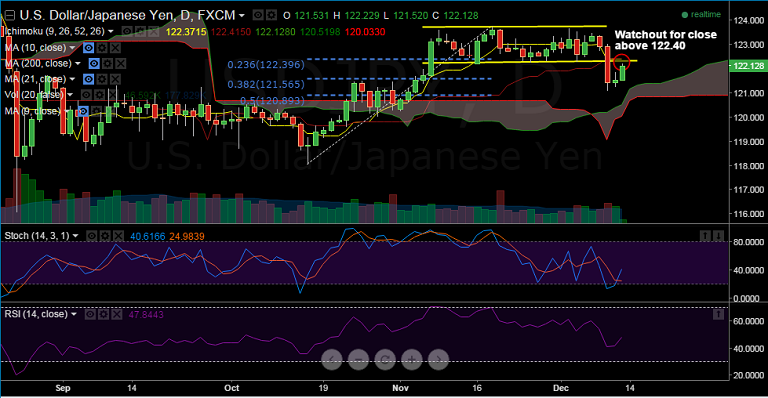

USD/JPY is extending its recovery from Monday's extensive slide, and has edged above 200 DMA at 121.58.

- Solid rebound staged by the Japanese stocks, which helped improve investors' sentiment helping the pair higher.

- Upcoming Fed hike also underpins the USD, markets now await a host of key US economic updates due later today for further direction in the pair.

- USD/JPY is curently trading at 122.14, with immediate resistance seen at hourly cloud top at 122.23, while support on the downside is located at 121.58 (200 DMA).

- A close above 122.40 could take the pair higher to 123.70 levels, but close below 200 DMA at 121.58 could see retrace to 120.89 levels.

- We would wait for breaks and close above 122.40 to go long.

Resistance Levels:

R1: 122.23 (hourly cloud top)

R2: 122.38 (Tenkan-Sen)

R3: 121.99 (38.2% Fibo 123.48-121.08)

Support Levels:

S1: 121.58 (200 DMA)

S2: 121.56 (38.2% Fib of of 118.07-123.77 rise)

S3: 121.24 (Dec 10 lows)