Trading call given on USDJPY: The underlying pair hits 108.280.

Trading tip advocated: “Contemplating above technical rationale, we advocate buying binary call options strategy with upper strikes at 108.025, this strategy is likely to add magnifying effects to the yields as long as the underlying spot FX keeps flying above strikes on expiration. Alternatively, maintain short hedges as it is with a view to arresting downside risks.”

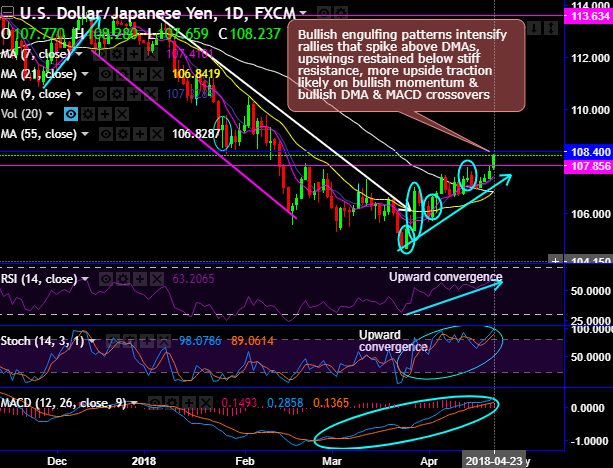

Technical rationale: Stiff resistance (107.856) break-out with healthy bullish momentum.

Trade result: Call successful. It is exactly shown a drag of rally after breaching of previous resistance as stated in our previous write-up.

The USD staged a strong recovery in the second half of last week, which has taken prices back to important resistance levels within the medium-term range. This comes as US equities have slipped back to the midst of their current trading range (a plethora of key tech stock Q1 earnings reports are due this week) and US yields have extended recent gains, with 10-year yields now close to the psychological 3% level.

Can US yields and USD drag their gains further? If this’s puzzling, keeping upper bracket of 108.400 as targets, we would like to maintain the same binary call option strategy that is likely to fetch exponential yields spot FX. Spot reference: 108.237.

Currency Strength Index: FxWirePro's hourly USD spot index has shown 68 (which is bullish), while hourly JPY spot index was at 32 (mildly bullish) while articulating at 12:48 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: