USDCHF lost its shine after dismal US jobs data. It hits an intraday low of 0.79726 and is currently trading around 0.79812.

Released on September 5, 2025, the US Non-Farm Payroll report for August 2025 showed a significant labor market slowdown, with only 22,000 jobs created—the fewest. Excluding the epidemic, the Great Recession missed the 75,000-job projection while the unemployment rate reached 4.3%, the highest since 2021. Revisions revealed a net loss of 13,000 jobs from past months, with job increases mostly in leisure and hospitality (50,000) and losses in manufacturing, trade, Utilities, together with an 86,000 job corporate layoff surge, With three-month job growth average of 35,000, down from 123,000 in 2024, falls short of the 50,000–75,000 required for population increase, therefore indicating employee hesitancy during a trade policy. trade and immigration uncertainty. The report's flaws as well as restrained salary growth reinforce expectations for a Federal Reserve rate cut at the FOMC meeting on September 16–17, With markets pricing in over 50 basis points of easing by year-end amid increased attention to labor data following President Trump's firing of a top Labor Department official,

Technical Analysis Points to Further Downside

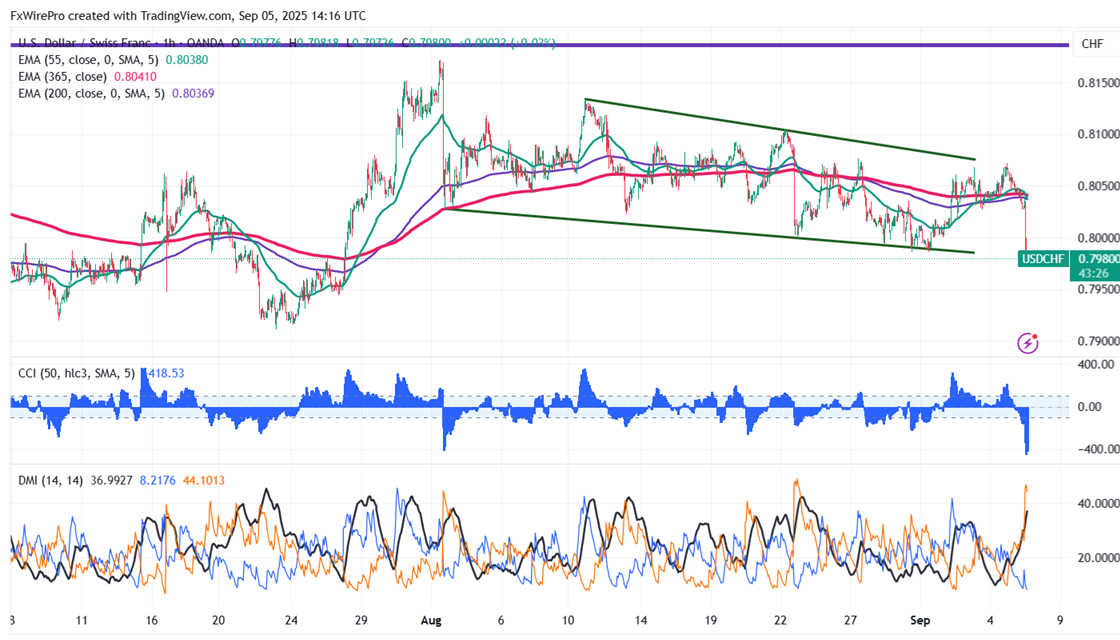

The pair is trading below the 55-EMA, the 200 EMA, and the 365 EMA on the 1-hour chart, indicating a bearish trend. The immediate resistance is at 0.8000; any break above targets 0.8070/0.8090/0.8135/0.8170/0.8215/0.8250.

Support Levels and Potential Declines

On the downside, near-term support is around 0.7960; any violation below will drag the pair to 0.7920/0.7860/0.7800.

Indicators (1-hour chart)

CCI (50) - Bearish

Directional Movement Index - Bearish

Trading Strategy Recommendation

It is good to sell on rallies around 0.8000 with a stop-loss at 0.8040 for a TP of 0.7860.