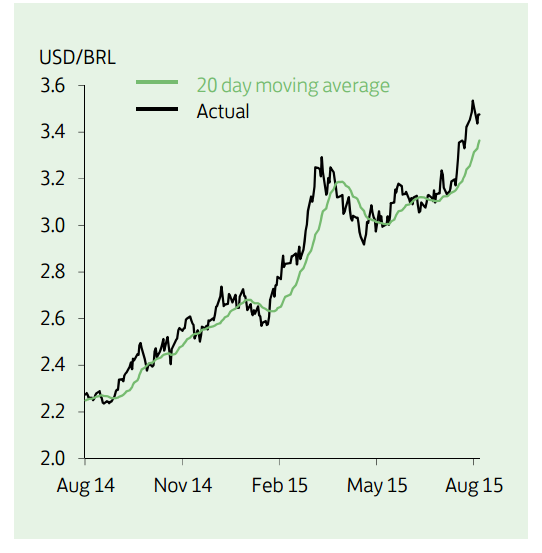

The BRL has been the worst performing EM currency this year with USD/BRL touching a near 2002 high in August of 3.5696. Internal and external factors have both added to depreciation pressures in recent weeks. Fears of a "hard landing" in China, combined with the recent depreciation in the CNY, and the threat posed by a Fed policy tightening, are expected to continue to weigh on the BRL.

Domestic developments are also playing a role. Inflation remains elevated, accelerating for a seventh consecutive month to 9.56%, well above the central bank's upper bound target of 6.5%. Meanwhile, any incremental carry support from higher interest rates will no longer be available as the central bank has for now signalled an end to its tightening cycle with SELIC at 14.25%. This, alongside the sharp downturn in economic growth and fiscal uncertainty leading to a possible credit ratings downgrade, will leave the BRL on the back foot.

USD/BRL Outlook

Thursday, August 13, 2015 12:48 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX