Peoples bank of China's (PBoC) two consecutive days of FX intervention via fix has resulted in sharp rally in bonds which led to drop in Yields. Bond prices and Yields are inversely correlated.

PBoC devalued Yuan by 1.9% on Tuesday and by 1.6% today, raising fears of all out currency war, which might lead to further uncertainty over policy actions from developed world including that of FED's.

Some investors are betting that US Federal Reserve might have to delay rate hikes amid slowdown in China and continued slack in US labor market.

Policy uncertainty led to loss of risk appetite on Tuesday, which is turning out as risk aversion after today's move.

Equities are down globally, which led to heavy appreciation in Yen.

- China's benchmark stock index Shanghai composite is down -1.06% in closing.

- S&P500 future indicating -0.75% drop in open.

- UK's FTSE 100 is down -1.3% so far.

- German DAX is down -2.45% heading into New York session.

- Pan European blue chip index EuroStxx50 is down -2.5% so far today.

Amid this sell off, Franc and Yen is the best performing major today, up 1.2% and 0.8% respectively today so far.

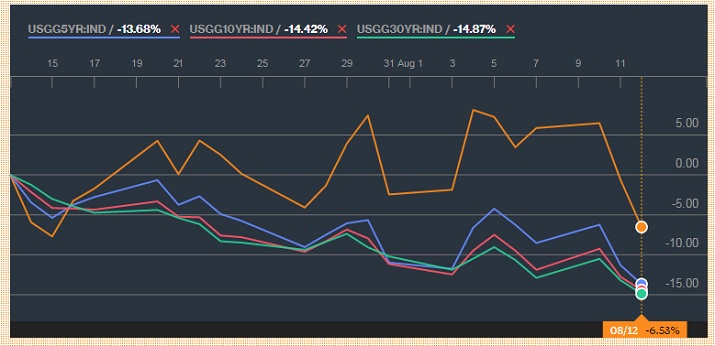

US treasuries have sharply gained since Tuesday, pushing yields down.

- Since Tuesday, US 2 year yields are down -13%

- US 5 year yield is down more than 7%.

- US 10 year yield is down more than 5%.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings