The United States economy is currently in a solid expansion state and for the first time since the 2008/09 ‘Great Recession,’ the U.S. is close to expanding at its long-term growth rate of 3.25 percent. While the uncertainties surrounding the U.S. mid-term election, President Trump’s Iran policies, and trade tension led to a loss of trillions of dollars in the stock market in October, hard data suggest that the economy remains well into an expansionary phase.

In October, the U.S. benchmark stock index, S&P 500 declined sharply from its high of about 8 percent, pushing the index (SPX500) from 2940 to 2700 area, but at the same time job numbers continued to point to solid expansion.

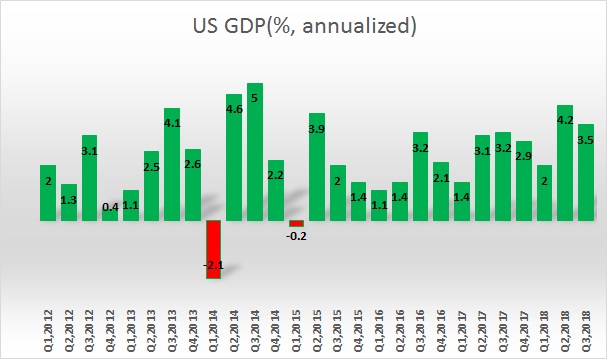

According to data from ADP, the U.S. economy added 227,000 new jobs in October, with 38,000 jobs being created in the goods-producing sectors. The GDP estimate also points to expansion. According to the latest reading, Atlanta Fed’s ‘GDP Now’ model is forecasting a 3 percent growth in the final quarter of the year, revised up from 2.6 percent. The U.S. economy has growth 2 percent in the first quarter of 2018, 4.2 percent in the second, and by 3.5 percent in the third quarter of this year.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals