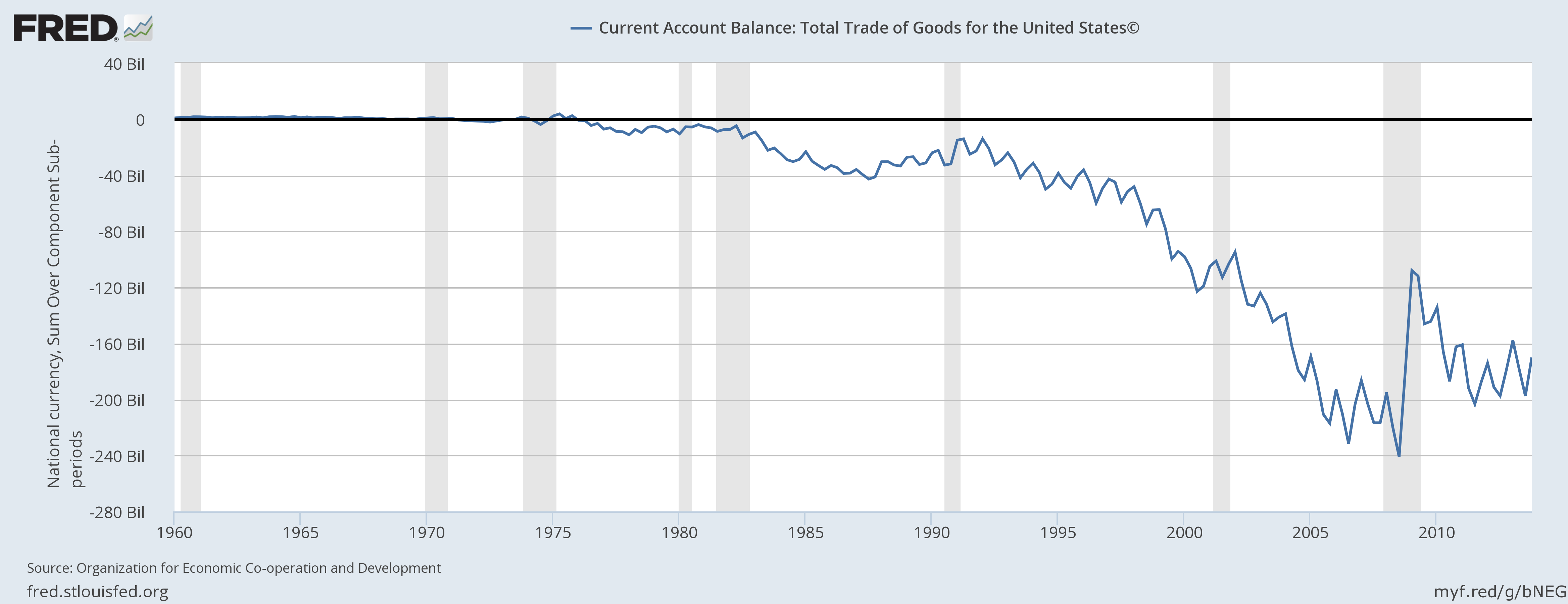

Donald Trump, the 45th President of the United States has made it crystal clear that renegotiating the current trade policies, which according to him are unfair, a key cornerstone of his Presidency. These charts show that he might be right.

In a previous article, we showed how the manufacturing sector started depleting in the United States since 1981, and gathered pace after the North American Free Trade Agreement (NAFTA) in 1994, creation of the Eurozone in 1999 and the inclusion of China into the World Trade Organization (WTO) at the start of the millennium. The goods balance of the United States ballooned from just $9 billion in 1981 to close to $200 billion quarterly. The trade deficit in the United States just rose from around $10 billion in 1998 to $68 billion before the Great Recession of 2008/09. As the imports got curbed after the recession, the deficit shrank but still hovering around $40 billion.

One of the key components has been the petroleum imports that reached its peak before the recession to above $40 billion but since then due to lower oil price and shale oil boom in the United States, trade deficit from petroleum has shrunken below $10 billion.

If Donald Trump can truly revive manufacturing with his policies, US is standing at a unique position to significantly reduce its trade deficits. Even if the exports do not improve, curbing imports would be sufficient to reduce the balance significantly. Reduction of US trade deficit would have an immense impact globally. Hence, we recommend to our readers to keep a close watch on the deficit numbers.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022