What drives stocks (other than cheap funding from FED), is their earnings, some which investors get returned in form of dividends and buybacks, rest of which goes into the books as reserves. And what drives earnings higher is actual sales and to some extent the efficiency.

Now US Federal Reserve has raised interest rates three times since the financial crisis, signaling that extraordinary monetary stimulus is coming to an end (no matter how gradual). So it would be now up to the economy and moreover revenue and earnings to support growth in the stock market.

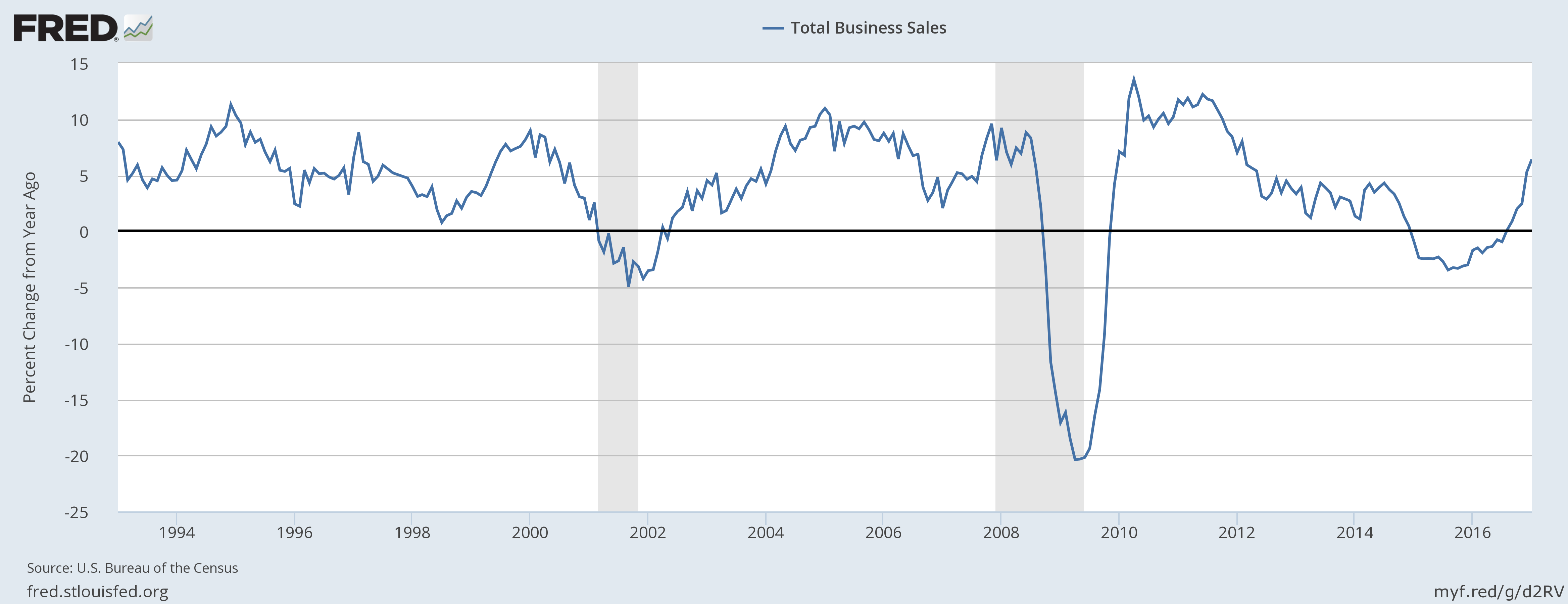

The recent data suggests that sales growth has been very encouraging and would help stocks race higher if that continues.

We expressed our concern last year as the growth dived into the negative and warned that it has well served as an indicator for looming recession in the past. However, since August last year, growth has returned to positive territory and since the US election outcome, it has just raced higher. This can be seen as a first ever change in direction since the rebound after the Great Recession. In January 2017, total business sales grew by 6.41 percent, the highest reading since February 2012. This is an early indication that the recent improvements in the soft data such as confidence are likely to be followed by hard data improvements.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off