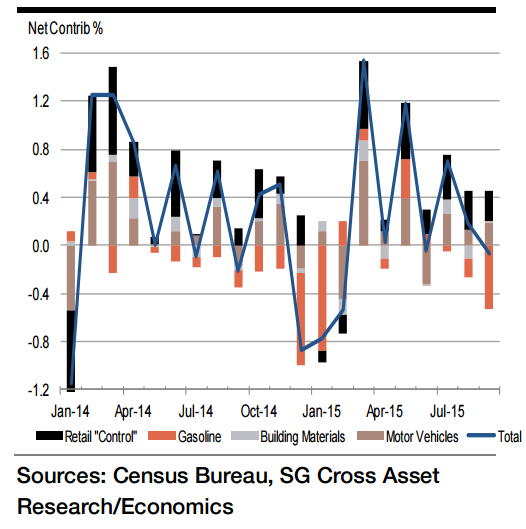

A tug of war between a price-induced drop in gasoline purchases and stepped-up consumer outlays on other goods and restaurant meals probably left retail and food services sales 0.1% lower in September, after a modest 0.2% uptick in August and a 0.7% gain in July. Retail gasoline prices tumbled by 9.7% to a seven-month low of $2.46 per gallon during the reference period.

After accounting for product supplied and seasonal adjustments, service-station receipts likely contracted by 6.3%, or by $2.35 billion, knocking one-half percentage point off the headline figure last month. Other areas of the Census Bureau's advance report are expected to provide support. Reflecting the strongest unit vehicle purchases in over a decade, auto-dealership revenues probably rose by 0.9%, boosting the cumulative increase since June to 2.9%. Excluding spending on autos, building materials (0.2%) and gasoline, so-called retail control outlays are forecast to have climbed 0.4% higher in September, extending the string of uninterrupted advances to seven months. Increased purchases of electronics, furniture and online items likely will contribute to that gain.

"Our retail control projection, if realized, would place the key input to government statisticians' goods-spending calculation over the July-September span 6.1% annualized above its Q2 average - the strongest performance since the spring of 2014", notes Societe Generale.

US retail and food services sales probably dipped in September

Tuesday, October 13, 2015 10:53 PM UTC

Editor's Picks

- Market Data

Most Popular

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns